Not many people can pay cash for a house these days. According to Zillow, the median home sale price in the United States ending October 2018 was $225,900. You are going to need a piggy bank the size of a house for that.

For most people, buying a home means taking out a mortgage. The two most common mortgage terms are 15-year and 30-year fixed rate mortgages. This brings us to the question of which should one go with that makes the most financial sense.

Recently there was an article on CNBC where experts Kevin O’Leary from “Shark Tank”, David Bach the author of “The Automatic Millionaire”, and Suze Orman all agreed that everyone should pay off their mortgages as soon as possible.

Personal finance guru Dave Ramsey tells everyone they should never get a 30-year mortgage so they can get out of debt quicker.

That means everyone should go with the 15-year mortgage, right?

Not exactly.

Table of Contents

Pros and Cons of 15-Year and 30-Year Mortgages

First off, lets look at the plus and minuses of the two different mortgage lengths.

Pros of a 15-year mortgage

| Pros of a 30-year mortgage

|

Cons of a 15-year mortgage

| Cons of a 30-year mortgage

|

With a 15-year mortgage, you get a lower interest rate, pay less in interest, and you pay off your home in half the time.

How is this possible? This is because a mortgage is an amortization loan. You are paying both down both the interest and the principal each month. However, in the beginning of the loan, most of your payments are going towards paying off the interest. With a higher monthly payment and lower interest rate in a shorter term mortgage, you are paying down the principal faster.

Let’s look at the numbers of an actual example.

Comparing A 15-Year To A 30-Year Mortgage

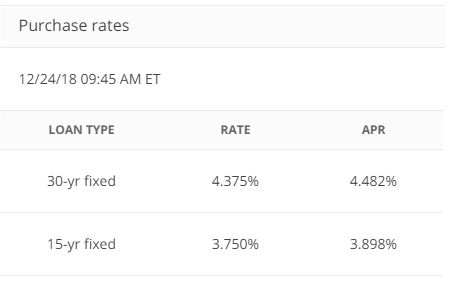

Right now for December 2018, Chase Bank is offering the below mortgage rates:

Assume you purchase a $250,000 house, and since you are no dummy, you put a 20% down payment, or $50,000 to avoid PMI. You go get a mortgage for $200,000.

With a 15-year fixed rate mortgage:

Monthly payment: $1,454

Total interest paid: $61,800

Total payments: $261,800

With a 30-year fixed rate mortgage:

Monthly payment: $999

Total interest paid: $159,485

Total payments: $359,485

With a 15-year mortgage, you would pay an extra $455 a month, but save $97,685 in interest.

At a glance, this would seem like a great deal and you should pick the 15-year mortgage because you are saving a ton of money.

Why A 30-Year Mortgage Term Is Better

Here’s why a 30-year mortgage might be a smarter choice.

You can invest the difference in the monthly payments

Let’s see what happens after 30 years if you chose the 15-year mortgage loan. You will have paid off the house after 15 years. Then you take the $1,454 in monthly payments and put it into the S&P 500, which has an average annual return of about 7% since its inception after adjusting for inflation.

Using our compound interest calculator, after 15 years of regular contributions you will have $463,552 in your investment account.

Not bad, right? But wait a second.

Now instead of going with a 15-year mortgage, say you went with a 30-year loan and you invested the extra $455 a month difference starting at month 1. After 30 years, you will also have a paid off house. Thanks to the power of compounding and time, your investment account will have $558,324.

Like the story of the race between the rabbit and the turtle, by going with the longer length loan, you will arrive at the finish line with a paid off property just like if you chose a shorter term loan, but you will have an extra $95,000 in your pocket.

Some might be thinking if this is the case, why doesn’t everyone pick the 30-year mortgage then. Past stock market performance doesn’t mean the stock market will perform the same in the future and not everyone will invest the difference in payments religiously month after month, year after year.

Inflation and the time value of money

You’ve probably heard the saying that a dollar today is worth more than a dollar tomorrow. Ok, maybe not tomorrow, tomorrow, but definitely a decade from now.

The reason for this is inflation, which increases the price of goods and services over time.

When my parents bought their home in 1978, they paid $48,000. Back then the starting salary of a college graduate was $15,051. Fast-forward thirty years to 2008 and the starting salary of a college graduate is $49,224 and the average house is now over $200,000.

Knowing that the value of money in the future is worth a lot less, how should someone take advantage of this?

They should get a fixed rate mortgage with the longest term. This is especially true right now because interest rates are low. Your monthly payment will be the same three decades from now. You will be paying down a loan in today’s dollars with money from the future. You want to stick it to the banks? This is how you do it – by paying them back with the future’s worth-less money.

More flexibility

The advantage of a 30-year loan is it gives you options. Even though you have a 30-year mortgage, there is nothing stopping you from paying off your mortgage early. You can pay it off after 1 year, 10 years, 15 years, 30 years, or anywhere in between.

During the good times when you are doing well, you can put more money towards your mortgage and pay it off sooner. If something happens, you can scale your payments back and pay it off slower.

If you find a better investment, you can put your extra money from the longer mortgage towards that instead. For example, you can use the difference to pay down high interest credit card debt first. Or you can just save that money and build up your emergency fund.

Lower required monthly payments

Many people ended up in foreclosure during the Great Recession because they lost their job and were unable to make their mortgage payments. With a smaller payment, it is easier to make the payments if your income gets cut, you get sick, or life happens.

It is usually easier for someone to make a smaller $1k a month payment than a $1.5k monthly payment. There are a lot more $50k jobs than $100k jobs out there.

Where many people mess up is looking at the amount of money each month they are paying on their mortgage. They see because of the smaller payments on a 30-year loan versus a 15-year loan, they can afford a more expensive house. So they go out and buy a fancy McMansion.

Lenders aren’t helping either by pre-approving homebuyers for a larger loan amount since the lender can make more money in interest and closing costs. Because the bank will loan you a million dollars to buy a home doesn’t mean you need to. Some realtors also push their clients towards the more expensive houses in their budget range because they’d get a larger commission check.

What you should do is spend the same amount on the house as if you are going with the 15-year mortgage, but get a 30-year mortgage. Take the extra money from the lower payments from the 30-year mortgage and build up your savings so if you do lose your job, you will have a large emergency fund to get you through the lean times until you find another job. Once you have a decent sized emergency fund, put that money towards paying off your mortgage faster.

The difference in interest rates is less than you think

Looking at the above interest rates between the 15-year and 30-year mortgage, the interest rate on the 15-year mortgage is 0.625% lower.

When you consider that you can itemize and deduct the home mortgage interest on your taxes, the difference is even smaller. If you are in the 22% federal tax bracket and if your state tax rate is 6%, the after-tax interest rate for the 15-year mortgage is now 2.75% and the 30-year mortgage rate is 3.21%. The difference is now 0.46%.

Closing $ense

You will hear personal finance gurus say over and over again that the key to being wealthy is to have zero debt. Yes, being debt-free is a good thing. It lowers the amount of stress in your life and gives you peace of mind. But there is also good debt and bad debt. The truly wealthy put their money to work to make more money for them. One of these ways is using debt intelligently.

If you have a high income, but no self-control and will simply blow the difference in mortgage payments on cars, boats, and making it rain at the club, then following the Dave Ramsey model of getting a 15-year mortgage and achieving complete freedom from debt faster is a good idea.

If you are disciplined and understand how to take advantage of the opportunity afforded by a low interest, long-term fixed rate loan, then a 30-year mortgage will usually be a better choice.

When you are buying property as an investment and renting it out, then the 30-year mortgage makes more sense. You will have a lower payment with the longer term loan, thus increasing your cashflow.

No matter which mortgage you choose, one thing the personal finance experts got right is you should be out of debt by the time you retire.

Which mortgage do you think is best for you? Do you have any advice on how to pay off your mortgage faster?

Thank you!!! This was very helpful ? Reminded me time pay more attention to what and how I’m paying mortgage and other bills

You are welcome Cristina! It’s always a good idea to know where your money is going.

my husband and I refinanced our home in Jan 2023, my husband wanted it to be a 15year loan because he could make the payments due to his good paying job, and then in February 17th 2023, My husband passed away-something we where not expecting. He had always told me the house would be taken care of because of a paragraph in the contract, but when i looked into it and i have no help with this, the mtg that i had PHH, did a loan modification and it just made it worse…then last sept of 2023 they sold me to SPS mtg co. I am in the process of a loan modification, i asked for a 30 year loan to help bring the payments down, i have a part-time job and no help with any advice from anyone. I could use some…