April 15 may have come and gone, but if you are the plan administrator for a Solo 401k or any other ERISA retirement benefit plan, there is another IRS deadline that you need to pay attention to. Neglecting to file a Form 5500 or filing one late can result in costly penalties.

The major benefit of opening a Solo 401k is the ability to contribute more than all the other tax-deductible retirement accounts available to a self-employed individual. The one “downside” you may have seen mentioned when opening a Solo 401k is the “additional paperwork” that is involved if you are acting as your own plan administrator. This additional paperwork is the yearly filing of the Form 5500 once your Solo 401k account reaches $250,000.

In this post, I am going to go over everything you need to know about the Form 5500, provide instructions on how to fill out a Form 5500-EZ for a Solo 401k, along with giving an example of a completed Form 5500-EZ.

Table of Contents

Where To Find Out More Information About The Form 5500

You can find out more about the Form 5500 and download instructions on how to complete a Form 5500 by going to the IRS Form 5500 Page.

When Is The Form 5500 Deadline

The due date to file your Form 5500 is the last day of the seventh month after the plan year ends. For those with a calendar year plan, the deadline is July 31.

Form 5500, Form 5500-SF, or Form 5500-EZ?

There are three types of Form 5500. The Form 5500-EZ is for one-participant plans only; Form 5500-SF is for one-participant plans and plans with fewer than 100 participants; Form 5500 is for plans with 100 or more participants.

Form 5500 and Form 5500-SF must be filed electronically through the ERISA Filing Acceptance System (EFAST2).

Form 5500-EZ can be filed electronically on EFAST2 or with a paper form and mailed to the IRS at:

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0020

As of January 1, 2024, it is now mandatory to file the Form 5500-EZ electronically if you are required to file at least 10 returns of any type with the IRS during the calendar year. This includes information returns such as W-2 and 1099 forms, income tax returns, employment tax returns, and excise tax returns. Failure to file electronically if required is considered not filing the form, even if a paper Form 5500-EZ was submitted.

One-participant retirement plans covers a business owner with no other employees. This includes the owner and their spouse, or one or more partners and their spouses in a business partnership.

If you have a Solo 401k, you are eligible to file a 5500-EZ. However, you may not need to file a 5500-EZ at all if the total plan assets at the end of the calendar year did not exceed $250,000 unless it is the final plan year of the plan. You can refer to the IRS Instructions on Form 5500-EZ for more details.

As a Solo 401k plan administrator, I prefer to complete and mail the two-page 5500-EZ because it is one less account to register and remember the login for.

For information on whether you need to file a Form 5500, or how to complete the Form 5500-SF, you can download the Instructions for the Form 5500 or Instructions for Form 5500-SF.

What Are The Penalties If I Forget To File A Form 5500

With the passage of the SECURE Act, the penalty for not filing a Form 5500-EZ on time for a plan year is $250 per day, up to a maximum of $150,000 plus interest! This is for each late form. Not filing the required forms for 10 years could mean you can owe up to $150,000 in penalties.

If you forgot to file a Form 5500-EZ, the IRS / Department of Labor offers a penalty relief program if you correct the delinquency before they notify you. You will have to file the delinquent returns and pay a fee of $500 per return, up to $1,500 per plan.

You are no longer eligible for the penalty relief program if the IRS sends you a penalty notice – CP 283, Penalty Charged on Your Form 5500 Return.

What If I Need An Extension

You can get a 2.5 month extension by filing a Form 5558 with the IRS before the due date of your Form 5500.

What Else Do You Need To File A Form 5500

To file a Form 5500 with the IRS, you will need an Employer Identification Number (EIN). If you do not have an EIN, you can apply for one by:

- Filling out the online EIN application and receive your EIN instantly

- Completing a Form SS-4 and faxing it to the IRS fax number in the SS-4 Instructions

- Completing a Form SS-4 and mailing it to the IRS’s “Where to File” address in the SS-4 Instructions

How To Complete the Form 5500-EZ

It may vary for other trustees, but with Fidelity, every May they mail out an Annual Valuation Statement to help you complete your Form 5500. This statement includes the value of your Self-Employed 401k account on January 1 and December 31. It also includes any cash contributions made during the year along with any distributions taken.

If you haven’t already, download the Form 5500-EZ and the 5500-EZ Instructions from the IRS website.

Part I – Annual Return Identification Information

See the instructions to determine if you need to check any of the boxes in this section.

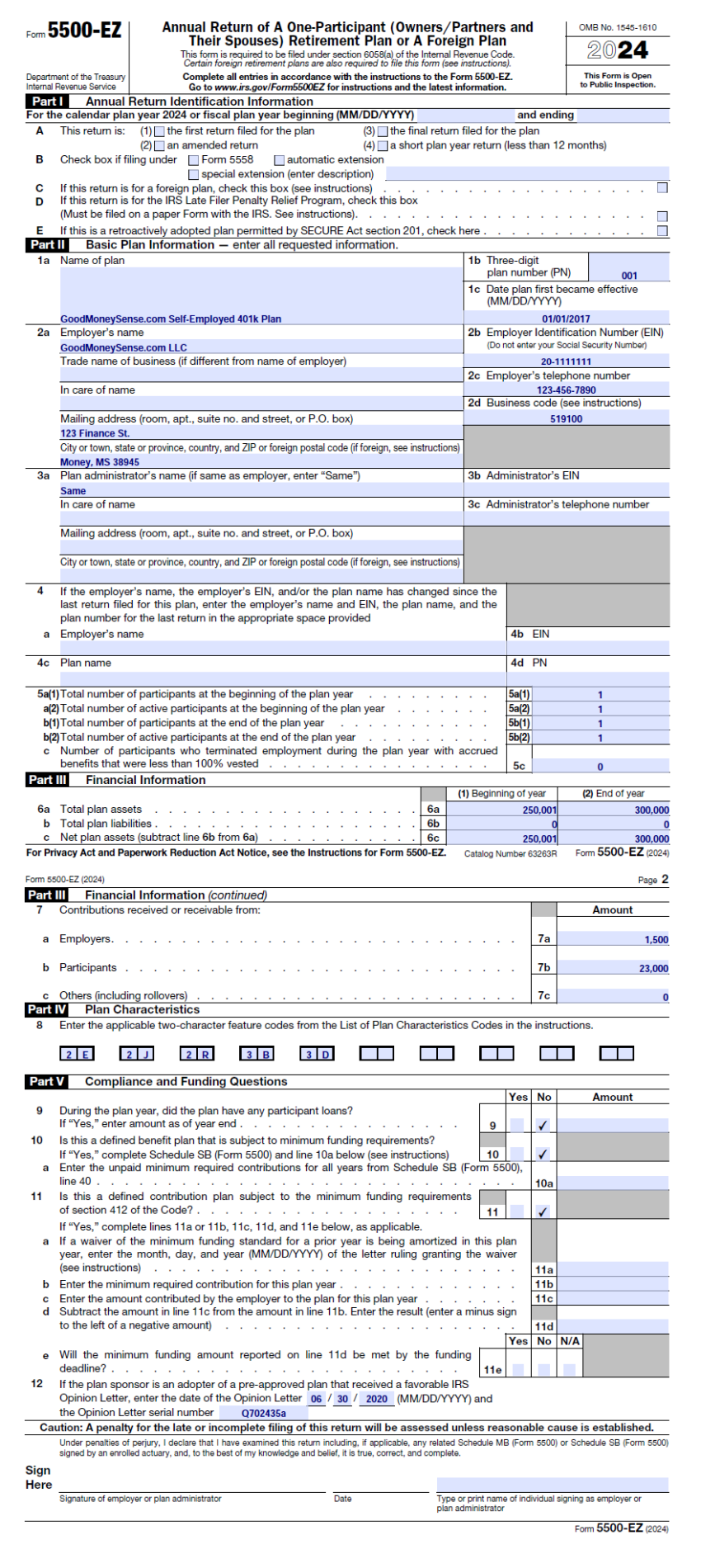

Part II – Basic Plan Information

1a. Name of Plan – Enter the formal name of the plan.

1b. Three-digit plan number – Plan numbers are consecutive, starting with 001. Once this number is chosen, you will use this same number for all future filings for the plan listed in 1a.

1c. Date plan first became effective – This will be the first day of the plan year or the date that the business was established.

2a. Employer’s name and address

2b. Employer Identification Number – See above on how to apply for an EIN if you do not have one already

2c. Employer’s phone number

2d. Business code – You can find the business code in the instructions. This is usually the same business code used on your Schedule C

3a-c. Plan administrator’s name, address, EIN, and telephone – Enter “same” in 3a if it is the same as the employer’s info and leave the rest blank.

4a-4d. If any of the employer’s details have changed since the form was filed for this plan, enter the employer’s info from the last form here

5a-5c. Total number of plan participants

Part III – Financial Information

6a. Total plan assets – You can find this info on your Annual Valuation Statement from your trustee if you received one. Otherwise, look on your account statements.

7a. Employer contribution – Enter the amount of the employer profit-sharing contribution. For a Solo 401k, this is up to 25% of compensation.

7b. Participant contribution – Enter the amount of the employee salary deferral contribution. For 2022, the annual elective deferral limit is $20,500

7c. Other contributions – Enter all other contributions such as rollovers and transfers

8. Plan Characteristics – You can find the plan characteristic codes in the instructions. The below codes are for a profit-sharing Solo 401k plan with Fidelity.

2E – Profit sharing

2J – Section 401k

2R – Participant-directed brokerage account as an investment option

3B – Plan covering self-employed individuals

3D – Pre-approved pension plan

Part V – Compliance and Funding Questions

9-11. Enter “Yes” or “No” and any dollar amounts as they apply

12. Favorable IRS Opinion Letter – *New for 2023* – Enter the date and serial number if plan sponsor is an adopter of a pre-approved plan that received a favorable IRS Opinion Letter

Opinion Letter Date and Serial Number

In the Year 2023 of the Form 5500-EZ, the IRS has added Line 12 asking for an IRS opinion date and serial number if your plan sponsor is an adopter of a pre-approved plan that received a favorable IRS Opinion Letter.

You can find these two details in the 401k Plan Documents from your plan provider.

- Charles Schwab: Schwab Individeual 401k Basic Plan Document – Page 35

- E-Trade: Individual 401k Plan Documents – Page 67

- Fidelity: Defined Contribution Retirement Plan Basic Plan Document No. 04 – Page 35

- Vanguard: Individual 401k Basic Plan Document – Page 49

For Fidelity, you can also find this information on their Understanding Form 5500 page on their website. Click on the FAQ tab and expand the line “What are the date and opinion notification numbers of the latest plan opinion letters”.

Sample 2024 Form 5500-EZ

The below completed 2024 Form 5500-EZ is for a Solo 401k profit-sharing plan at Fidelity for an internet publishing business, such as a blog or website.

You can find the previous versions of our Sample Form 5500-EZ here for the years: 2017, 2018, 2019, 2020, 2021, 2022, and 2023.

Closing $ense

It is easy to forget to file a Form 5500-EZ, especially when the deadline is in the middle of summer, when we are long done with taxes and thinking about vacations at the beach instead. My recommendation is to put a reminder on your phone’s calendar or whatever you use to keep track of dates.

The 5500-EZ is a quick two-page form that only takes 10 minutes a year to fill out. After you’ve filled out your first return, keep a copy and refer to it in future years. With a one-participant plan, when you’ve saved up over a quarter-million dollars in your 401k to necessitate completing the form, the 5500-EZ will not really seem that big of a bother to complete.

Related:

Where to Save for Retirement After Your 401k

This Year’s Maximum 401k Contribution Limits

For tax year 2019, if the deadline to submit is July 31, 2020, does mailing it on July 29, 2020 via certified mail count? I just got an IRS notice for a late filing with a bill for a late filing penalty? Thanks.

Usually, for IRS filings the postmark on the envelope is the indicator of timely filing. Since you also sent it by certified mail, I would think you’d have proof you filed it on time. I would give them a call to see what they say. Due to the pandemic, there is the possibility they may have not even processed the form yet. I had filed my federal taxes by mail last year and the IRS is showing my taxes as N/A and it’s May 2021.

If you make the contributions for the tax year 2020 in calendar year 2021, what do you put for contributions on form 5500-EZ? The form that Fidelity sends (Annual Valuation Statement) seems to include cash contributions that were deposited in calendar year 2020 which would have actually been my 2019 year contributions.

I can’t say what I did was correct, but I put down what Fidelity listed on the Annual Valuation Statement.

Fidelity’s statement goes by what was contributed in the past calendar year and not the tax year. I assumed the Form 5500 EZ is for the past calendar year too since in Part III 7a-c, it asks for the assets in the beginning and the end of the year and the top of the form says “For the calendar plan year 2020” (unless you elect to go by fiscal year).

I’m going to insert disclaimer saying this is not professional advice and you may want to talk to the IRS or a tax professional if you want to be absolutely sure.