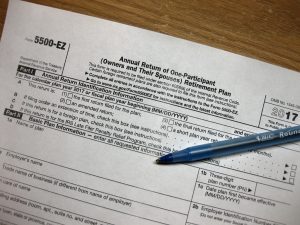

How To File The Form 5500-EZ For Your Solo 401k in 2024

April 15 may have come and gone, but if you are the plan administrator for a Solo 401k or any other ERISA retirement benefit plan, there is another IRS deadline that you need to pay attention to. Neglecting to file a Form 5500 or filing one late can result in costly penalties.

April 15 may have come and gone, but if you are the plan administrator for a Solo 401k or any other ERISA retirement benefit plan, there is another IRS deadline that you need to pay attention to. Neglecting to file a Form 5500 or filing one late can result in costly penalties.

The major benefit of opening a Solo 401k is the ability to contribute more than all the other tax-deductible retirement accounts available to a self-employed individual. The one “downside” you may have seen mentioned when opening a Solo 401k is the “additional paperwork” that is involved if you are acting as your own plan administrator. This additional paperwork is the yearly filing of the Form 5500 once your Solo 401k account reaches a certain size.

Before I started doing my taxes myself, I had a CPA and each year I would receive a manila folder from him that was almost an inch thick containing a copy of my tax return and all the supporting worksheets. I think that was his way of justifying how much I was paying him for tax services. That folder would join the other folders from previous years in a big file cabinet never to be taken out again… until last fall when I had to move the cabinet to paint the room.

Before I started doing my taxes myself, I had a CPA and each year I would receive a manila folder from him that was almost an inch thick containing a copy of my tax return and all the supporting worksheets. I think that was his way of justifying how much I was paying him for tax services. That folder would join the other folders from previous years in a big file cabinet never to be taken out again… until last fall when I had to move the cabinet to paint the room. It’s that time of the year again that no one looks forward to. 1099’s are showing up in the mailbox which means tax season is right around the corner.

It’s that time of the year again that no one looks forward to. 1099’s are showing up in the mailbox which means tax season is right around the corner. If you are like many other people, you are probably doing your taxes right now or getting ready to do them. If you have already filed your taxes and are getting a tax refund, congratulations!

If you are like many other people, you are probably doing your taxes right now or getting ready to do them. If you have already filed your taxes and are getting a tax refund, congratulations!