Learn how you can get free credit scores, a free credit report, and even free credit monitoring when you join CreditWise from Capital One.

A decade ago, one of the most popular companies that offered people their credit score for free would also enroll them into a 7-day free trial for credit monitoring services. If they did not cancel the trial membership, they are billed every month for eternity.

Skip forward to today and many financial institutions and credit card companies now offer your credit score for free without any of these sneaky tricks.

By providing you with an additional service such as free credit scores, the company keeps you coming back to their website and their name on the top of your mind. When you decide to apply for a credit card, mortgage, auto loan, or other financial services, they hope you’ll think of them.

One of my favorite services that offer free credit scores is CreditWise from Capital One.

Table of Contents

What Is CreditWise from Capital One

CreditWise is the evolution of the old Capital One free credit tracking tool called Credit Tracker. Launched in 2014, Credit Tracker helped millions of consumers understand and monitor their credit score.

In 2016, Credit Tracker was rebranded as CreditWise with the addition of more tools and new features.

Although CreditWise is offered by Capital One, you do not have to be a Capital One customer to access it. Everyone can create an account in minutes by providing some personal information.

However, if you already have a Capital One account, you do not need to do anything else to access the CreditWise tool. You can sign-in on the CreditWise site using the same credentials as you normally use to log in to pay your Capital One credit card bill.

What I like about CreditWise compared to other free credit score sites that will remain nameless, is you are not bombarded with ads and upsells.

Besides access via the website, there is a mobile app available on the Apple App Store and Google Play.

CreditWise’s Credit Score vs FICO

The credit score you get on CreditWise is your VantageScore 3.0 score calculated from your TransUnion credit report. Your credit score is updated weekly.

The VantageScore model was created in 2006 by the three credit bureaus – Equifax, Experian, and TransUnion to compete with the FICO score from the Fair Isaac Corporation.

Both VantageScore 3.0 and FICO use the same 300 to 850 scale to rank your credit. However, the two scoring models differ in how the credit scoring factors are calculated. There is no way to determine your FICO score from your VantageScore and vice versa.

VantageScore credit scores are increasingly becoming more popular with lenders for making consumer-lending decisions. While it is not the official FICO score, your VantageScore still provides helpful information on how your credit is doing.

Capital One performs a soft inquiry when you use CreditWise. Creating an account and checking your credit score will not affect your credit no matter how often you check it.

The CreditWise Dashboard

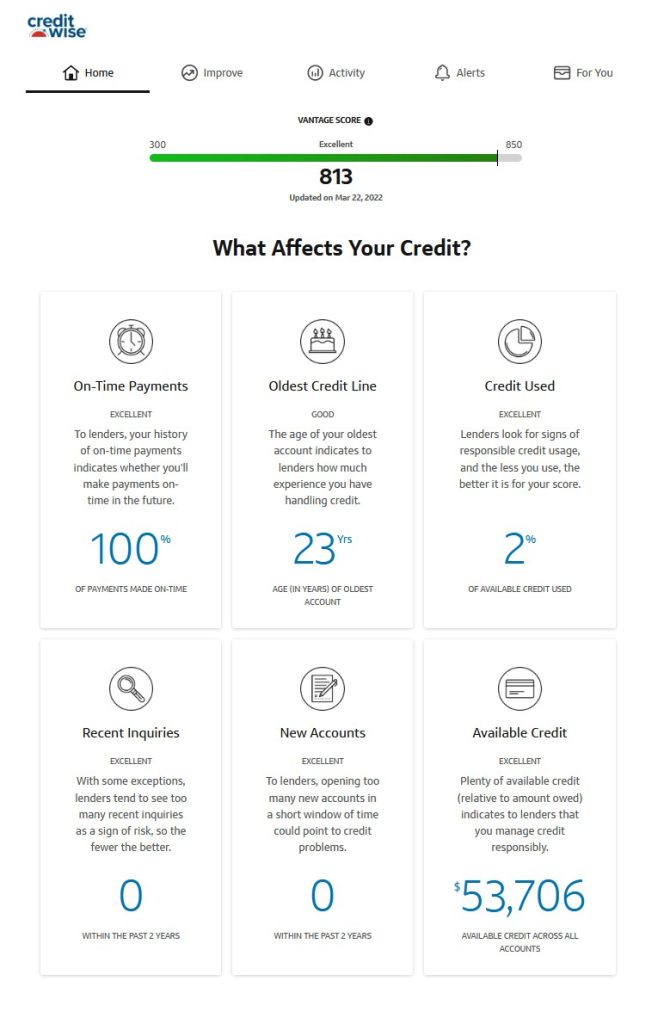

When you log in to your CreditWise account, everything is available right in front of you in an easy-to-read format.

You will see your VantageScore number and when it was last updated at the top.

Scrolling down, you will see the scoring factors used to determine your credit score and how you rate. These include:

- On-time Payments

- Oldest Credit Line

- Amount of Credit Used

- Recent Credit Inquiries

- Number of New Accounts Opened

- Total Available Credit

Additional Benefits of CreditWise

Besides free credit scores, you get other great features when you sign up for CreditWise.

Free Credit Monitoring

The most useful feature of CreditWise may be their free credit monitoring. CreditWise will monitor your Experian and TransUnion credit reports and send you an email alert when something changes.

This feature allows you to stay on top of what is happening with your credit reports, especially in today’s environment with all the recent data breaches.

My most recent experience with CreditWise’s credit monitoring was when I was purchasing a car a few years ago. I had given the dealership my info. While still sitting at the dealer waiting to go back into the finance office, I received an email from CreditWise notifying me that that was new activity on my credit report. Clicking the link in the email, I saw that the dealer had checked my credit.

Free Dark Web Monitoring

The dark web is the part of the internet where privacy and anonymity are paramount. There are legitimate reasons why people would use the dark web. However, criminals and hackers also use it to buy and sell stolen data.

CreditWise will monitor these online marketplaces and exchanges on the dark web daily for your personal data for free and will inform you if your Social Security number or email address appears online so you can take action.

Should your SSN be found on the dark web, CreditWise will also show you the date it was discovered and what other personal information was associated with the breach. These may include your name, address, phone number, and more.

Earlier this year, CreditWise alerted me that my data was found online. I attributed it to a recent hack in which 50 million customers’ information was stolen. The affected company had offered customers free identity monitoring for 2 years, but I never signed up since I already had CreditWise. The only issue I found with CreditWise’s dark web monitoring alerts is there was not an email notification. I had to log in to my account and go to the Credit & Identity Alerts page.

If you are notified your information is available on the dark web, the first step you should take is to freeze your credit at the three credit bureaus.

Free TransUnion Credit Report

Everyone can request a free credit report from each of the three credit bureaus once a year through AnnualCreditReport.com.

A year is a long time between checking your credit reports, especially when lenders report information to the credit bureaus every 30 to 45 days.

To keep you informed about what is going on with your credit data, CreditWise gives you free access to your TransUnion report.

Credit Score Simulator

Are you trying to improve your credit score? The CreditWise Simulator will estimate how your credit score could change when you take certain actions.

Options that you can play around with include:

- Pay off some or all of your credit card debt

- Make payments on time for 6 months, 1 year, 18 months, or 2 years

- Buy something with your available credit

- Increase the credit limit on your credit cards

- Sign up for a new credit card with new available limit

- Cancel your oldest credit card

- Take out a mortgage

- Take out an auto loan

- Get a personal loan

- Make a certain number of new credit inquiries or loan applications

- Allow an account to go delinquent for 30, 60, or 90 days

- Allow all accounts to go delinquent for 30, 60, or 90 days

Suggestions to Improve Your Credit Score

The Score Improvement page will give you suggestions ranked from the most impactful to the least that you can work on to improve your credit score.

This feature likely analyzes how you compare with other people with similar scores.

Improving your credit score is pretty straightforward if you have an idea of how the credit scoring factors work.

Getting personalized suggestions from CreditWise can give you something to focus on rather than taking a scattergun approach.

Closing $ense

CreditWise is a great, free tool to have in your financial toolbox. There are now many places you can get your credit score without paying a penny. What differentiates CreditWise from the rest is the powerful free credit monitoring features that come with the service.

The service is offered by Capital One, a Fortune 500 bank with over $370 billion in assets and 65 million active accounts. If you are already a Capital One customer, there is no reason why you wouldn’t set up the service. It only takes seconds.

If you are not currently a customer, I think it’s worth the time to create an account. You get much more than the simple credit scores that other sites offer without all the upsells for additional services such as credit cards, insurance quotes, and loan offers. I only saw one unobtrusive ad on the entire site the last time I checked.

Are you a CreditWise user? What do you like about the service? If not, what other sites do you recommend to track your credit score?