What if I told you I could save you or even make you a few thousand dollars and it wouldn’t even cost you a thing? What am I talking about? I’m talking about how to get an exceptional credit score.

Your credit score is a report card on how well you manage your money. This is no different than your report card when you were in school. When you do all your homework and do well on your exams, you get a good grade. The same thing happens with your credit score. When you pay your bills on time, you get rewarded with a high credit score. If you are constantly late with your bills, your credit score will suffer as a result.

A high credit score is more than a number to impress your golfing buddies or people at your office Christmas party. While you can brag about having an 800+ credit score to show off your financial acuity, a good credit rating does have a practical purpose. Lenders use your credit score to determine how responsible you are with money and whether you will pay your bills on time. An outstanding score means you can get the lowest interest rates on credit cards, auto loans, mortgages, or business loans. It could even get you better rates on your car insurance.

Even if you have no plans to borrow money, with an awesome credit rating you can get approved for any credit card with big signup bonuses that could add up to thousands of dollars in free money or even hundreds of thousands of points for use on travel and hotel stays.

Table of Contents

What Is A Good Credit Score?

There are two types of credit scoring models – FICO and VantageScore.

The most often mentioned type of credit score is the FICO score, created by the Fair Isaac Corporation. FICO scores range from 300 to 850.

The VantageScore is the second type of scoring model commonly used by lenders. Developed by the three credit bureaus – Equifax, Experian, and TransUnion, the current VantageScore 3.0 model uses a range from 300 to 850 similar to the FICO score.

Generally, what ranges are considered poor to excellent will vary depending on which sites you check. The below listed ranges are how Experian categorizes them.

FICO Score Ranges:

| Credit Score | Rating | % of People |

| 300-579 | Very Poor | 16% |

| 580-699 | Fair | 17% |

| 670-739 | Good | 21% |

| 740-799 | Very Good | 25% |

| 800-850 | Excellent | 21% |

VantageScore Ranges:

| Credit Score | Rating | % of People |

| 300-499 | Very Poor | 5% |

| 500-600 | Poor | 21% |

| 601-660 | Fair | 13% |

| 661-780 | Good | 38% |

| 781-850 | Excellent | 23% |

A credit score that is 700 or higher is usually considered good. With a score in this range, applicants are very likely to be approved for credit at competitive rates.

To get the lowest rates and best terms from credit card companies and lenders, you will want a credit score in the 760 to 800+ range.

How to Find Out Your Credit Score for Free

Before you set off on improving your credit rating, you have to find out what your credit score is in the first place. You can’t improve on something if you don’t know where you stand initially. You might even have a higher credit score than previously thought.

There are a couple of options to find out your credit score.

You can get your FICO score from the Fair Isaac Corporation by signing up at myFico for a monthly subscription plan starting at $19.95 / month. There is also the option to get a one-time report with your score from a credit bureau of your choosing for $19.95 or getting a report from all three bureaus for $59.85.

My recommendation for getting your credit score is to sign up for Credit Karma or Credit Sesame because it’s free. Free is always good. Credit Karma and Credit Sesame make money by offering you credit cards and other financial products, but you are not obligated to sign up for any of them.

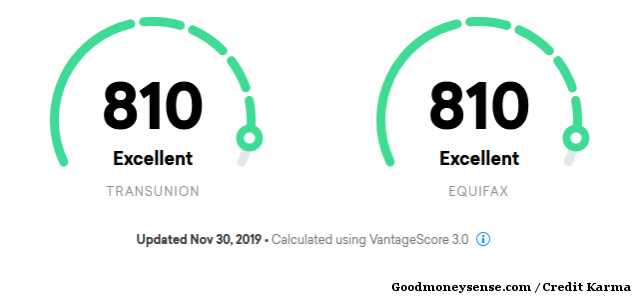

After spending 5 minutes entering your details and creating your account at Credit Karma, you will have immediate access to your credit score. Credit Karma provides the VantageScore 3.0 from both TransUnion and Equifax.

Steps to Getting A Perfect Credit Score

Earning an excellent or even a perfect 850 credit score might seem impossible. However, it is actually easier than you might think. Both the FICO and VantageScore credit scores are calculated based on the information from your credit report.

The Fair Isaacs Corporation actually reveals the five credit scoring factors used to calculate your FICO score. VantageScore uses those same factors but assigns a different value to each category. After all, there are only so many things that can be considered based on the information in your credit report. If you have an excellent FICO score, your VantageScore will likely be close behind.

When you were in school, to get a good grade on your report card, you needed to go to class, do your homework, participate, and do well on your exams. Getting a good credit score is similar. You need to make the grade on all five of the credit scoring categories.

Luckily, Credit Karma tells you exactly what you need to do to get an excellent score. To get a perfect score, here are the five factors and what you need to do:

1. Payment History – Pay All Your Bills On Time

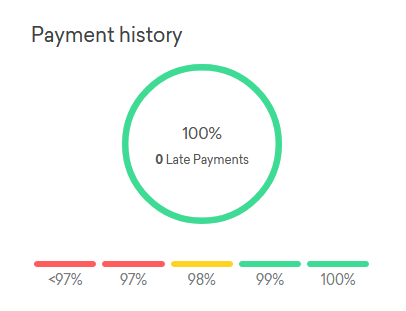

Payment history is the most important factor in determining your credit score. This category makes up 35% of your score. To do well in this category, all you need to do is pay your bills on time, every time. It’s that easy.

To get a perfect grade in this category, Credit Karma wants you to have 100% on-time payments.

Here is how Credit Karma scores your payment history.

Let’s say you’ve had one credit card for 5 years. That means you had 60 possible monthly payments. If you had one late payment, your payment history score will be:

59 on-time payments / 60 possible payments = 98.3% paid on time

That puts you in the yellow category, which isn’t that good.

Now let’s assume you have two credit cards, each for 5 years. You have 120 possible payments, but you also missed one payment. Your payment history score is now:

119 on-time payments / 120 possible payments = 99.2% paid on time

That puts you in the green category, which is much better.

Now consider what happens if you only had a credit card for a year and you missed one of the payments:

11 on-time payments / 12 possible payments = 91.2% paid on time

You are now deep in the red and you’ve got a lot of work to do to dig yourself out.

As you’ve probably noticed, the shorter the time you’ve been using credit, the more likely you’ll get a low score if there is a missed payment. And the more credit cards you have, the less your score will be affected by one forgotten payment. You are being rewarded for having a longer credit history and responsible credit usage. Getting a good credit score or fixing credit problems is not a quick process.

If you missed a payment and your on-time payment percentage is poor, it doesn’t mean you will never get a good credit score again. From this day forward, make all your payments on time. Delinquencies and negative items on your credit report only stay on your credit report for about 7 years. A late payment that is only 3 months old will have a bigger impact on your payment history than one that is 3 years old.

To keep your credit from getting dinged, you should make all your installment loans on time and in full. Common examples of installment accounts are mortgages, car loans, student loans, and personal loans. Next, pay your credit card balances. I always say you should pay your credit cards in full every month, but in a pinch, the minimum monthly payment counts as an on-time payment if it is made by the due date.

2. Credit Utilization – Don’t Max Out Your Credit Cards

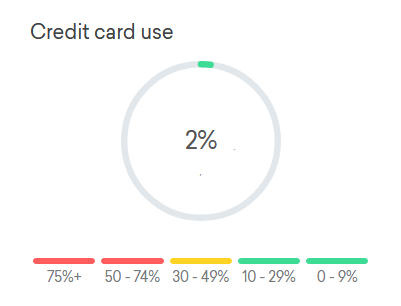

The second largest factor that affects your credit score is your credit utilization ratio. This makes up 30% of your score.

Your credit utilization ratio is the amount of credit you are using out of the total amount of credit you have available. The lower your utilization ratio, the better your score. It’s like a catch-22. The credit card companies are willing to loan you a ton of money, but they don’t really want you to spend much of it.

When the credit bureaus see you using a higher percentage of your available credit, they start thinking you might be in financial trouble and down goes your credit score.

Here is how to calculate your credit utilization ratio. If you charged $500 to your credit card ordering a lot of takeout this month and your card has an available limit of $5,000, your ratio is calculated as:

$500 balance / $5,000 available credit = 10% utilization

Personal finance gurus will tell you that you should keep your credit utilization ratio under 30%. As you can see below, Credit Karma scores anything between 10% and 29% as in the good range.

If you are trying to get an excellent or perfect credit score, you will want to do better and use 9% or less of your total credit lines. Keep in mind the amount of credit used matters both for each individual card and across all your credit cards.

The trick to getting good credit isn’t about never using your credit cards to keep your balance and therefore credit utilization percentage low. Instead, you should get more credit. This could mean either getting more credit cards, more credit cards with higher credit limits, or asking for credit limit increases. Having more credit available means if you ever have a big emergency, putting the charges on a credit card won’t have a big negative impact on your credit score.

There is a myth where some people believe that you should keep a balance on the credit card to show the credit bureaus that you are using the card, thinking it will boost their credit score. So some people pay off their card except for a few dollars remaining. This is unneeded and leads to you paying unnecessary interest. Credit Karma shows the exact date your credit card company reports your balance to the credit bureaus. If you have a positive balance on that date, that amount is reported and the bureaus will know you are using your cards.

Credit Karma providing the date your credit company reports the balance to the credit agencies also has an additional benefit. If your utilization ratio is too high for a particular month, you can make a prepayment to your credit card and lower your balance before it is reported.

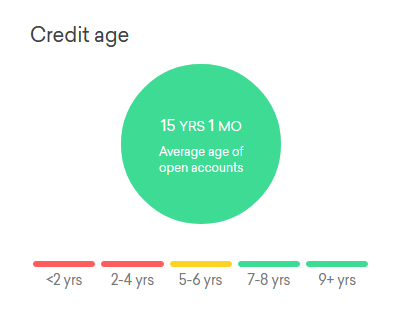

3. Length of Credit History

When I previously mentioned that getting a perfect score is not a quick process, this third factor is a major reason why. According to Credit Karma, to get the highest score possible, your average age of credit needs to be 9+ years old.

The good thing is the length of your credit history only makes up 15% of your credit score.

If you are a credit newbie, your best course of action is to open up a bunch of credit card accounts now and keep those accounts open indefinitely. This is especially important because the FICO and VantageScore considers the average age of your accounts, not to be confused with the total length of your credit history. The more accounts and the sooner you open those credit accounts, the stronger your foundation will be as the accounts age.

For example, you have two credit cards that are 12 years and 10 years old. Your current average credit history age is:

(12 + 10) years / 2 credit cards = 11 years old

That puts you in the top of the score range.

Then you decide to get a new card because they are offering a ton of bonus points. The average length of your credit history is now:

(12 + 10 + 0) years / 3 credit cards = 7.3 years old

As you can see, you’ve now dropped into the bottom of the good range.

Now consider what happens if you have a dozen credit cards that are all 10 years old and you open a new credit account today:

(12 cards * 10 years + 0 year) / 13 credit cards = 9.2 years old

Your credit history barely budged from opening the new account.

The benefit of credit card accounts is you have full control over how long they are open. If the oldest line of credit on your credit report is a five-year car loan, once you’ve paid off the loan, that account will eventually fall off your report after 7 to 10 years. When that happens, your score could drop.

To keep your credit cards active and in good standing, once or twice a year put a small charge on the cards and pay them off at the end of the month. So go ahead and order yourself the avocado toast with your credit card as a reward. You’ve earned it for using credit responsibly.

You might be wondering why the credit scoring models use the average age of your accounts and not the overall length of your accounts. If someone suddenly started opening many accounts, the credit agencies think maybe their financial situation has changed and they are now a greater lending risk. If they looked at the total credit length instead, then everyone who got a credit card at 18 will have 9+ years of credit history by the time they turn 30 years old and this factor will be meaningless.

After you’ve done everything in this category as recommended, the only thing left is to wait.

4. Recent Credit Inquiries

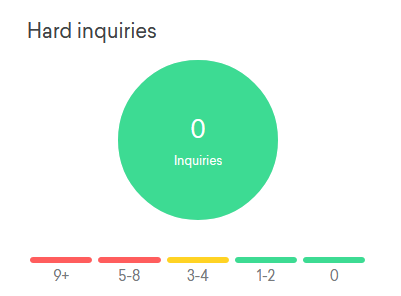

The next category that affects your credit score is how many new hard inquiries are showing up on your credit report. This has a 10% impact on your credit score.

Hard inquiries appear on your credit report every time you go apply for credit or a loan. This includes credit cards, mortgages, student loans, personal and other loans. Too many hard inquiries in a short period of time can raise red flags to lenders. Someone who opens a bunch of new accounts in a short period of time might be riskier to lend to because they may be having financial hardships such as problems paying their bills or overspending.

To get a perfect credit score, Credit Karma recommends that you have 0 hard inquiries.

Someone who is going around getting new credit cards and loans might find their credit score dropping suddenly. The hard inquiries may have a small part in that outcome but aren’t the full reason for the decrease. What else may be the cause for the big drop is the new credit accounts also reduces the average age of your credit history. Combined, these two factors make up 25% of your score.

The good news is hard inquiries only show up on your credit report for two years. My hard inquiry when I went car shopping in December 2016 is no longer being listed as seen above.

Hard inquiries are only a temporary ding on your credit score and it should bounce back after a few months. After 9-12 months, their effects tend to fade away.

Other good news is if you are applying for a mortgage or auto loan, the credit bureaus expect you to shop around to get the best rates. You could go to six different lenders and have your credit ran six different times in a short period of time and it will only be counted once. The length of time varies depending on the scoring model and is typically between 14 to 45 days.

If you are planning to get a big mortgage or loan in the future, you should plan ahead so by the time you need the loan, your hard credit inquiries will have dropped off your report. This is also true if you are in the process of building your credit score. It is better to take the hit earlier in your credit history when you aren’t thinking about applying for loans yet.

5. Credit Mix and Total Credit Lines

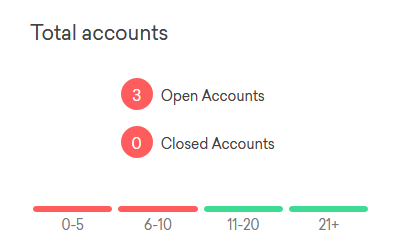

Finally, the last aspect that affects your credit score is your credit mix. This makes up 10% of your score.

To get the highest score possible, Credit Karma expects you to have 21+ total lines of credit, whether they are currently open or closed.

Having a variety of credit, whether that is a credit card, a mortgage, or an auto loan, you are showing lenders that you can handle credit responsibly and will make your payments on-time as expected.

This may seem kind of backwards with the credit scoring models rewarding people for getting more credit cards and having more loans. When you are doing great financially, lenders are happy to offer you more money. The instance you show evidence of actually needing money, you get penalized with a dropping credit score with higher rates and harder access to money.

Having lots of credit lines available also ties in with the other credit scoring categories. You will have higher limits and therefore lower utilization ratios. You will likely have a long credit history, which means more on-time payments.

The truth is, the credit mix is only 10% of your score. I wouldn’t get loans and open lines of credit just to bump up this number. For many of us, these numbers will increase naturally with time. Looking at my above info, I have only three open accounts and I still have an 800+ credit score.

Closing $ense

In summary, if you have a low credit score or are trying to improve your credit in anticipation of getting a big loan or mortgage, follow this advice and you will see your credit score shoot up.

Getting a perfect credit score isn’t a huge secret especially when Credit Karma outlines exactly what needs to be done. To recap, all you have to do is:

- Pay all your bills on time and never miss any payments

- Keep your credit utilization ratio below 10% on all your credit cards

- Establish credit early or once you’ve established your credit history, keep the average age of your accounts over 9 years

- Limit the number of hard inquiries appearing on your credit report to 0 or as low as possible

- Have a good mix of credit accounts with 21+ total open or closed accounts

In addition to checking your credit score regularly using Credit Karma or other credit scoring sites, you will also want to regularly get your free credit report from AnnualCreditReport every 12 months from each credit reporting agency to make sure there are no mistakes or unauthorized accounts opened in your name.

Do you have any tips and tricks to get a perfect credit score or how to improve your credit rating?