In the past month, I purchased a dashcam and a battery jump starter, and I made sure to use my Citi Double Cash credit card for the purchases. The reason? Certain Citi cards offer a free extended warranty benefit that automatically adds up to two years of extra coverage on top of the manufacturer’s warranty.

It seems whenever a warranty expires on an item, it breaks shortly afterward. It’s almost as if the manufacturer knew their product would work problem-free up until the end of the warranty period. Or maybe it’s Murphy’s Law.

When considering making a big purchase, the credit card that offers the most cash back, airline miles, or rewards points may not be the best card to pull out of your wallet. Here is one perk that may be worth more than any rewards that one might receive.

Table of Contents

Citi Credit Cards with Extended Warranty Protection

The following Citi credit cards will extend a manufacturer’s warranty by an additional 24 months:

- Citi Strata Premier

- Citi Prestige

- Citi Rewards+

- Citi / AAdvantage Platinum Select World Elite Mastercard

- Citi / AAdvantage Executive World Elite Mastercard

- American Airlines AAdvantage MileUp

The following cards have extended warranty coverage effective November 2024 that will extend the factory warranty up to 24 months, but with slightly different coverage terms:

- Citi Double Cash

- Citi Custom Cash

If you are unsure if your Citi credit card has the extended warranty coverage, you can go to the Citi Card Benefits page to view the benefits available with your cards. Once logged in, select the card in question and look for the “Extended Warranty” tile under the “Shopping & Additional Benefits” section.

Extended Warranty Benefit Returns to Citi on Select Cards

Citi previously offered the two-year extended warranty benefit on the Citi Dividend and Citi Double Cash cards, but it was removed in September 2019. The extended warranty coverage was discontinued alongside other cardholder benefits when Citi drastically reduced the benefits available across its credit card offerings.

However, in November 2024, cardholders received an unexpected email announcing that up to 24 months of extra warranty coverage would be available again for eligible purchases on the Double Cash and Custom Cash cards.

Citi Extended Warranty Coverage Terms: Pre-November 2024 Cards

For all Citi credit cards besides the Double Cash and Custom Cash, the extended warranty benefit is among the most generous in the industry.

You receive two extra years added to your warranty, totaling up to 7 years of coverage.

There are no hoops to jump through or special steps to get the extended warranty coverage.

The cardholder only needs to use an eligible Citi credit card or ThankYou Points to purchase a covered product.

The Citi warranty coverage will begin when the manufacturer’s and any extended warranty end.

Citi will repair, replace, or reimburse up to the amount charged on the card, up to $10,000.

Items not covered include:

- Boats, cars, aircraft, motor vehicles, or tires

- Professional services

- Used or antique items

- Land and buildings

- Plants and live animals

Coverage does not apply if the buyer neglects to care for or service the item as required by the manufacturer. Additionally, coverage is void if the product has a defect, is subject to a recall, fails due to normal wear and tear, or is damaged by an act of God.

For the full benefits that come with these Citi credit cards, view the guide here.

Citi Extended Warranty Coverage for Double Cash and Custom Cash Cards

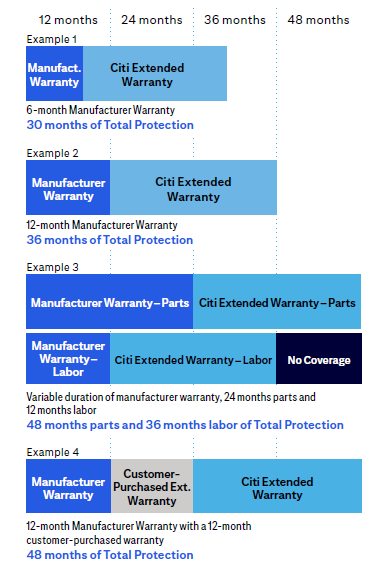

The extended warranty coverage for the Double Cash and Custom Cash cards differs from the one offered by Citi for its other cards. Instead of adding 24 extra months, it doubles the original manufacturer’s warranty up to 24 months.

“Extended Warranty doubles the time period of your Covered Purchase’s original Manufacturer’s Warranty or Store Warranty up to the maximum of twenty-four (24) months following the day that the Manufacturer’s Warranty or Store Warranty expires”

For items with a one-year manufacturer’s warranty, you get an extended warranty of one year. This makes the warranty on the Double Cash and Custom Cash cards similar to the extended warranties offered by other credit card issuers.

Products with an original manufacturer’s warranty of 18 or 24 months get an even better deal. You will get an extra 18 months or 24 months added on top of the original warranty period.

Items not covered include those listed above plus:

- Floor models without an original manufacturer’s warranty

- Software and media such as DVDs and CDs

- Consumables, perishables, and limited-life items such as rechargeable batteries

- Items purchased for resale and commercial use

- Losses caused by power surges and physical damage to items

View the guide here of the full Mastercard benefits for Double Cash and Custom Cash cards.

How to File an Extended Warranty Claim with Citi

For Double Cash and Custom Cash Cards

To file a warranty claim for the Double Cash and Custom Cash card, you can visit mycardbenefits.com or call 1-833-251-6404.

You have 60 days from the date of failure to report the claim.

Warranty coverage is offered by Mastercard. You can manage the claim and track your claim status on the mycardbenefits.com website.

For All Other Citi Credit Cards

You can file a claim by calling 1-866-918-4670 or visiting mybenefits.cardbenefitclaims.com to submit a claim online.

You have 180 days from the date of failure to return all requested documents.

Warranty coverage is handled by Assurant. You can start a claim, check status, or upload documentation through the portal. Expect a response within two weeks once all required information is submitted.

Closing $ense

If you have the Citi Double Cash or Custom Cash card, it is great news that Citi has brought back the extended warranty coverage. Not only do you get a cash back reward for using these no-annual-fee cards for purchases, but you now have extra protection for those purchases.

For cardholders of the more premium Citi cards, the extra 24-month warranty coverage is unmatched by other competing issuers.

I submitted a warranty claim to Citi after two WD Red hard drives failed during the extended warranty period following the expiration of the 3-year manufacturer’s warranty. I purchased these drives using the Citi Dividend card before Citi removed the coverage in 2019. I was able to get the full purchase price back as a statement credit.

Did the extended warranty benefit on a credit card ever come in handy? Any recommendations on which card offers the best coverage?