A couple of weeks ago our rice cooker stopped working so I made a trip to Walmart to pick up a new one. The first store I tried was all out of stock. I guess this is what happens when people completely empty Costco of 50lb bags of rice and now need a way to cook all that rice. I made it to another Walmart to grab the last one available. When I go to check out, the associate asks if I wanted an extended warranty for my $25 rice cooker.

This brings up a dilemma facing many shoppers after they spent months saving up to make a big purchase. Should one spend the extra money on an extended warranty to protect their purchase? For most people, buying an extended warranty is not worth the money. Better ideas include taking advantage of the free extended warranty protection that comes with using your credit card when buying the product, shopping at retailers that give you a longer warranty for free, setting money aside that would have gone to buying the warranty in case something does break, and buying quality products.

Extended warranties are a good deal for stores that sell them and a bad deal for consumers that buy them.

Table of Contents

Why Extended Warranties Are Popular With Retailers

According to Warranty Week, extended warranties are a huge business with Americans spending $40 billion a year on them in 2016. This figure breaks down to $17 billion for vehicle service contracts and $23 billion on consumer protection plans for things like appliances, laptops, smartphones, televisions, and homes.

The reason many salespeople push warranties on shoppers is because of the huge profit margins the stores earn from selling them.

It has been estimated Best Buy makes more than half of its profits from selling extended warranties. Some analysts have reported that these warranties bring in 18 times the margins that the retailers earn from regular product sales alone.

It is estimated that 20 cents out of every dollar spent on extended warranties is paid out in claims. That means many consumers don’t end up using these warranties after purchasing them. Would you still buy something if you were told you were paying hundreds extra for a product but not getting anything in return for your money?

Why People Buy An Extended Warranty

When someone is spending hundreds to thousands of dollars on pricey electronics or a new car, they might think adding a low-cost warranty plan to the purchase is a no-brainer.

The average cost of an extended service contract for electronics and appliances is about 17% of the product’s price. This is about par with the extended warranty on my Walmart rice cooker. For an extra $4, I get an extra 3 years added on top of the manufacturer’s 1-year warranty.

Reasons people buy an additional warranty:

Peace of Mind

The primary reason most people buy an additional warranty is for the peace of mind. They are spending a lot of money for a product. They worry about and over-estimate the probability the item is going to break early on in its life.

You always hear stories on how once the initial warranty is over, a product fails soon after with the theory that if the manufacturer designed their products to last longer, they would have offered a longer warranty to back that up. Having an extra warranty puts people’s minds at ease.

Protect Against Unexpected and Costly Repairs

Unless you are knowledgeable about a particular product, people expect the worst for the costs to repair an item when it stops working. Often times the parts to repair a mechanical or electrical failure might be cheap, but the labor isn’t. A product goes bad and you now have to dish out for unexpected and expensive repair bills you did not budget for.

With the majority of Americans having little to no savings, something such as their car breaking down could cause a big financial hardship.

Protection From Accidental Damages and Theft

The manufacturer’s warranty only covers products from manufacturer defects. Product damage from spilling coffee on your laptop, dropping your cellphone into the toilet, knocking your tablet off the desk, getting your DSLR camera stolen from your car, and other similar mishaps aren’t covered by the manufacturer’s warranty.

The only time one might benefit from a warranty plan is for things that are used often and extremely expensive, such as smartphones. A klutz who drops their iPhone and electronics often resulting in broken gadgets regularly might get their money’s worth for buying insurance or extra warranty protection like AppleCare for their devices.

No-Hassle Warranty Replacement and Repair

When a product breaks and you decide to get it fixed, an extended warranty can make the entire process much easier. No worries about whether you are getting a good price, needing to call around to get quotes, or go looking for an authorized repair specialist.

You can simply call up the warranty company who will send someone out or send you a box and label to ship it off to get it repaired. If it is determined that the item isn’t fixable, it will be replaced.

Why Extended Warranties Are Not Worth It

Consumer Reports’ advice regarding extended warranties is that “in nearly every case, it’s not worth the extra money when buying electronics and appliances”. Many other personal financial advisors will tell you the same thing.

Reasons why an extra warranty might not be worth the money include:

Products Don’t Break As Often As Imagined

Yes, your laptop, dishwasher, toaster, or stove you just bought is going to stop working. It might not be today or tomorrow, but one day you are going to hit the power button on your TV or microwave and nothing is going to happen.

No manufacturer wants a reputation for their products being branded as having poor reliability and craftsmanship. Consumer Reports estimates the probability of a Sony flat-screen television failing in the first 5 years is just 11%.

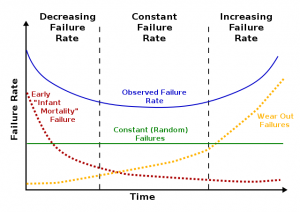

For most things, the probability of it breaking follows something called the bathtub curve. Envision a graph with the failure rate on the Y-axis and time on the X-axis. The failure rate is shaped like a bathtub (the blue line). There is a higher probability of it failing at the beginning of its life, also known as the infant mortality period. This is where you have the initial manufacturer’s warranty to replace anything that goes wrong in the beginning due to manufacturing defects. If it doesn’t fail at the start of its life, the chance of it failing decreases dramatically. Your product will then continue working for a long time, assuming you take good care of it. Then the possibility of the item failing increases again as it gets towards the end of its useful life as parts wear out.

Extended warranties are an insurance policy sold by insurance companies. These companies have done the probability and statistical models to calculate the likelihood your flat-screen television or washing machine will need repairs and how much it would cost to come up with the cost of the warranty.

My previous rice cooker lasted over 4 years before it died. Had I gotten an extended warranty when I bought it, it would have been outside the coverage period anyways.

Repair Costs Aren’t Always That Expensive

Take for example 4 years of premium support for a $600 Dell laptop. On Dell’s website, the extended warranty costs $229 dollars, which is more than enough to replace most individual components in a laptop that goes bad. I’ve owned my current laptop for a decade and in that time, I’ve replaced the hard drive after 2 years for $50, the LCD screen for $80 after 4 years when it developed dead pixels that gradually became a dead spot, and got a new battery for $14.

Thanks to YouTube and sites like iFixIt, you can find instructions on how to tear down and repair many simple things yourself if you are handy.

When you get an extended warranty plan, you are hedging your bets. Will you experience a costly failure during the time the warranty is in effect versus having a minor problem or no problems at all?

Repairs Are Not Always Worth It

Having an extended warranty might even work against you. For example, you have a home warranty and your HVAC system stops working. Rather than replacing it with a newer and more efficient model, the warranty company might try to cut costs by band-aiding a product that has reached the end of its life.

Instead of getting a new appliance that could work reliably for years without trouble, you end up wasting your time waiting for repairmen to come fix the problem again and again as something else breaks. If it is your fridge, it might mean spoiled food and wasted money each time it happens.

This is even truer for tech products such as cell phones, iPads, computers, televisions, and more. As technology advances, older devices get surpassed by newer and better models that are bigger, faster, and have more features at lower prices.

A 60” Samsung plasma TV was over $4,000 in 2012. A 65” Samsung 4K LED Smart TV now costs $700 on Amazon in 2020. That extended warranty from 2012 could be the cost of a new TV a few years down the road. A decade-old computer might be so slow, it might be better to replace it with a new one with better specs than continue to repair it.

The Fine Print

Insurers are in the business to make money. To do that, they try to limit the number of claims.

Read the policy documents to see what events are covered. You might discover that accidents, wear and tear, misuse, abuse, modifications, pre-existing conditions, theft, lack of maintenance, or things like natural disasters are excluded.

Alternatives To Buying An Extended Warranty

Before you purchase an additional warranty, here are a few options to consider instead:

Check Your Credit Card’s Benefits

Many credit cards from Capital One, American Express, Chase, and Bank of America, offer an extended warranty of 1 year on top of the manufacturer’s warranty.

When I’m making an expensive purchase, I prefer using my Citi card, which extends the warranty up to 2 years, for a maximum of 7 years total.

Some cards also offer accidental damage and theft protection for 3 months from the date of the purchase.

Costco Extended Warranty For Members

Costco automatically extends the manufacturer’s warranty up to 2 years for televisions, projectors, computers, and certain appliances from the date of purchase.

When you combine this with using the Costco Anywhere Visa Card by Citi for the purchase, you can get an additional two years added to the warranty on top of that for up to 4 years. This was one of the reasons we went with Costco when we bought Lenovo Ideacentre computers for a family member’s new office.

Take Advantage of More Generous Manufacturer Warranties

Even though it is getting rarer and rarer, some brands still offer very generous warranty coverage. There are some products that even have a lifetime warranty.

Examples include Craftsman and certain Harbor Freight hand tools, Zippo lighters, JanSport backpacks, Cutco knives, many brands of computer memory, CamelBak products, RAM Mount phone/GPS/tablet holders, Columbia outerwear, and more.

Self-Insure Your Purchases

Instead of spending the extra money for a warranty, take the money you would have spent and put it into a separate bank account. Even better if this is an interest-earning online savings account. When an item breaks or needs repairs, you will have the money available to fix or replace it.

If something doesn’t break, you have the money available as an emergency fund that can be used for anything. That is better than having a few hundred dollars locked up in a warranty.

Read Reviews Before Buying

You might not need an extended protection plan in the first place if you do your research before buying.

Read the reviews on the product from people who’ve already bought it on sites like Amazon, Best Buy, and Walmart. Head over to Consumer Reports to see what brands are recommended.

Choose a different model or a different brand if those reviews show lots of problems. Reviews are some of the best ways to get an idea of people’s actual experience with a product.

Closing $ense

Before you decide to open your wallet the next time for a big-ticket purchase, take a moment and consider the likelihood of the product failing and the costs to replace or fix it before spending extra for warranty protection.

The people most likely to purchase warranties are lower-income people who may not have the extra money available to replace a broken item. The end result is they are spending more of their hard-earned money than wealthier people to get the same product. Someone who can’t afford to pay BMW repair prices shouldn’t be buying a BMW in the first place.

How do you feel about extended warranty plans? Have you bought one before? Did it pay off or did it not?