In a January 2019 survey, Bankrate found that 60% of Americans were unable to pay an unexpected $1,000 expense. That is a lot of people who are living paycheck to paycheck and barely saving any money.

The survey also revealed that 77% of respondents said that either they or an immediate family member had to deal with a financial emergency in the last year that was $1,000 or more, with 36% of those facing a bill greater than $5,000.

With 77% of respondents not having at least $1,000 in savings for an emergency, to get out from a financial setback means they will need to borrow money from somewhere. 20% of those surveyed said they would need to take out a personal loan or finance the charges on a credit card and pay over time.

Paying interest to borrow money means it will be even harder for them to save money to build up an emergency fund for the next money emergency that happens. This is equivalent to trying to dig yourself out of a hole while the dirt keeps falling back in.

Think back in the last twelve months of all the things that have happened in your life or to someone who you know that resulted in big surprise expenditures. My brother got a screw in a tire so he had to replace that tire and another that was approaching its tire tread wear indicators. My mother needed a new stove. My father’s laptop died and he needed a new computer.

You might think who would ever consider using rent-to-own stores when they charge a premium over the actual cost of an item. Yet those businesses do extremely well renting big-ticket items to people who can’t afford them. When someone doesn’t have an emergency fund and doesn’t qualify for a credit card; making monthly payments is their only solution when they need to replace a broken refrigerator, stove, or computer .

Table of Contents

America’s Personal Savings Rate

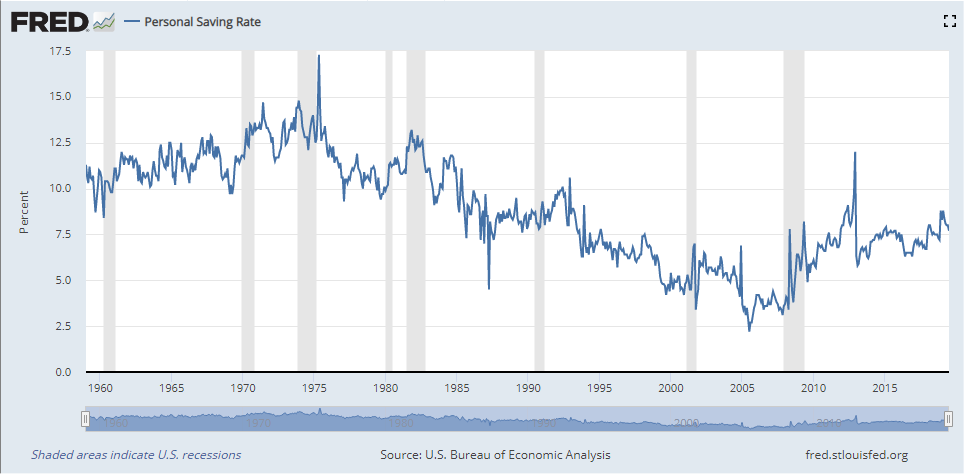

The above graph from the U.S. Bureau of Economic Analysis shows the personal savings rate for Americans. Since peaking in the 1970s, the savings rate has been on a slow and steady decline.

Right before the Great Recession in 2007, the personal savings rate was just 3.1%. After considering inflation, the average American was basically saving nothing.

The gray vertical bars on the graph is when the United States was in a recession. You can see that during each recession, the personal savings rate goes up. This shows that people are able to save money if they had to. It just took a fear of losing their jobs and the economy’s uncertainty to kickstart their savings.

However, after every recession except the recent Great Recession, the savings rate dropped back down once the economy started doing well again and people started feeling more secure.

Look around the next time you are out and take note of all the late model cars on the roads. Check out how full the parking lots are at restaurants and lounges on the weekend. When times are good, people forget about the last downturn and loosen their purse strings more.

But just like Thanos, the next recession is inevitable. This is why savings and an emergency fund is important.

An analysis by Forbes found that after the Great Recession, the personal savings rate increase came from mostly high-income earners. The middle-class families and families on the lower end of the income distribution went back to cutting back on their savings.

This brings up a couple questions. How can one increase their savings? What can we do when 1 in 5 working Americans aren’t saving any money at all? When asked in a survey by Bankrate on why they aren’t saving, the most common reason was because they had too many expenses.

Simple Tips and Tricks To Save Money

You know you need to save money, but saving is hard and it’s difficult to stick with when it feels like you are depriving yourself. These 6 easy techniques will make saving money easy without having to eat beans every day.

Pay Yourself First

You’ve probably heard finance gurus throw around the words about paying yourself first. It doesn’t mean writing yourself a check to go buy yourself a fancy new wardrobe.

To pay yourself first you take money out of your paycheck and immediately transfer it to your savings, investment, or retirement account before spending a cent.

The idea here is if you are someone who sees they have money left in their checking account the day before the next payday and can’t resist spending it, by limiting the amount of money in your account, you can continue to spend like normal. The only difference is you end up with more money each month.

The trick with making this work is to automate your savings so you never see the money before it hits your account. If you have to log into your bank’s website to make the transfer, you will probably stop doing it regularly.

Instead, go to your work’s payroll department and have them set up direct deposits to split up your paycheck to go to your different accounts.

If your work can’t do this, the next way is to schedule automatic transfers. If you know you get paid on the 15th and 30th of each month, then set up a process to regularly transfer money from your checking account to your savings account the day after payday.

If you saved $120 each time you got paid every two weeks, in one year you would have saved over $3,000. That could be enough for an emergency fund for when things go sideways.

Consider How Many Hours Of Work It Costs

One way to decide if something is worth buying is breaking the cost down to the number of hours you would have to work to pay for it. When we go to work, we are trading our life for money.

Let’s say you are making $20 an hour at your job. If you go out to eat for lunch and you pay $10 for a Popeyes Classic Chicken Sandwich, a Spicy Chicken Sandwich, and a drink because you had to know if it was as good as everyone says it was, you are paying for it with half-hour of labor. Was it worth it? Maybe.

Or you take your spouse and kids to the theater and after paying for movie tickets and snacks, it costs you $60 for a couple hours of entertainment. That is three hours of work you traded for a night out. Maybe you could have gotten the same amount of enjoyment if you stayed in and got snacks from the grocery store and watched the movie when it came out on Netflix.

We all have a limited amount of time available in our life. It is up to you to decide whether something is worth trading your time for it. We shouldn’t waste our time on things that don’t bring value to our lives. It is a lot easier to not buy something than spend more time and effort working to pay for it.

Don’t Buy It Now

If you are on eBay, and you see something that you really want, don’t click the Buy It Now button no matter how much you want to. Instead, go sleep on it and buy it tomorrow.

Same thing with Amazon’s 1-Click Ordering button. If you have that ordering option set up, go back on the site now and disable it. I don’t even have my credit card saved on Amazon. I use a virtual credit card number that can only be used one time only. Each time I want to order something off Amazon, I have to login to the credit card company’s site and create a new number.

By stepping away from the computer, coming back to the store another day, or creating hurdles you have to jump through before buying something, such as freezing your credit cards in a bowl of water, you can lower the temptation of impulse purchases.

If you slept on it and decide you still want the item tomorrow, then buy it. Many times I’ve found I no longer wanted to purchase something after I gave it more time. I either forgot about how badly I needed the item or I got distracted by something more important.

Or maybe I just have a lousy memory or attention deficit disorder. Either way, don’t buy it now.

Think About the Future Value of Money

When you save and invest your money, its value will grow over time through compound interest. The more you invest, the faster it grows. Each dollar that you spend now slows that growth than if you had saved it instead.

For example, instead of buying coffee at Starbucks each day before work, you took that $5 you saved and invested it in an S&P 500 index fund. With a historical average annual return adjusted for inflation of 7%, that $5 will grow to $38.06 after 30 years.

Is that one coffee worth spending $38 in future money? That is with just one day of not buying coffee too.

If you stopped buying coffee from the coffee shop, made the coffee yourself at home costing you only $5 a month, and you invested the $75 you would have saved every month, you will have an account worth $88,204.86 after 30 years.

More: Use our compound interest calculator to see how money will grow over time.

Think of all your other purchases the same way. Before you buy something, ask yourself if it is worth spending the equivalent value now than if you had saved and invested the money.

You just might decide that your iPhone 10 is good enough and you didn’t really need to spend $700 or $5,328 of the future money’s value on a new iPhone 11.

If after thinking about it and you do decide it would be worth making the purchase, then go ahead and buy it. Just like there is a fine line between being cheap or being frugal, for each person there is a certain point between living in the moment and enjoying life or saving for the future.

We really do only live once and life should be about balance. You don’t want to completely deprive yourself and live like a monk. Then when you die and donate all your money to your favorite college only for them blow it all on a fancy scoreboard. Nor would you want to spend all your money and end up in retirement eating ramen every day.

Ask Yourself Is It Worth The Money

Another way of thinking of this would be if someone gave you the option of taking the money or having the item. Which one would you choose? If you decide to take the money, then the item probably wasn’t worth buying.

Take a look around you at all the things you thought you really needed. Things you bought, used it once, and never touched it again. In such a situation, you might think back and wished you had the cash instead.

Before you buy something, do a quick cost analysis. Do you really need the item? How often do you plan to use it? Would this particular item make your life easier? We tend to subconsciously do this every time we are comparison shopping.

If you decide you don’t need the item or don’t plan to use it much, it might make sense to not buy it or buy the cheaper version.

Maybe you don’t really need an expensive pair of running shoes for walking when a basic pair would work. Or that $600 treadmill you’ve used 6 times and are now using to hang your laundry, making it an expensive coat rack that cost you $100 every time you actually used it as designed. I’ve bought cheaper tools from Harbor Freight instead of Craftsman because I was only going to use them a few times and would probably never touch them again.

By thinking whether you would rather have the cash and how often you are going to use something, you will be spending a lot less money and saving money for things that offer more personal satisfaction.

Bank Your Savings

Another neat trick to boost the amount in your savings account is to save your savings. Each time you do something to save some money, immediately transfer that money over to your savings account.

By banking your savings, you will see immediate results from your efforts. This should hopefully spur you to look for other places where you can save money.

Let’s say you followed our tips on how to save money on your cell phone bill, and that netted you an extra $20 a month. That is extra money you didn’t have before, so take that cash and stash it in your bank’s savings account each month.

Then if you followed our tips on how to save money on food and instead of buying Skippy brand peanut butter, you picked up the store brand instead. For each item where you reduced your costs; used a coupon to get a discount; earned cash back from your credit card and etc, add up the total savings from that shopping trip and put that into your savings.

Over time you will see your account balance grow and see your hard work pay off.

Bonus Tip: Make More Money

Yes, this method is the solution to every money problem in the world if only it was so easy. The brutal truth is at some point you will have done everything you can possibly do to save money.

You could be living out of a box truck at your work’s parking lot, became a minimalist, stopped eating out, and line dried all your laundry. There is absolutely nothing else you can cut down anymore.

This is when you should stop trying to squeeze more pennies from your spending and focus on the big gains. This means increasing your income. This could be picking up a new skill, starting a side hustle, asking your boss for a raise, or even switching to a higher paying job.

But even doing those has its limits. There is only 24 hours in a day and everyone has the same amount of time no matter who they are.

This is why you should work on building a passive income stream. With passive income, once you put in the initial work you will keep making money even while you sleep. You are making your money work for you and not the other way around. This could be buying dividend producing stocks, building a business, starting a blog, becoming a Youtuber, building a rental property portfolio, doing p2p lending, and more.

Closing $ense

By putting these six strategies to work and sticking with it, you should start seeing your money in your savings account grow. Before long, you will have a bunch of money that you didn’t have before. This should prepare you for any unexpected expenses that pop up.

Like all things, it’s always tougher in the beginning. This includes learning how to switch your mindset from being a spender to becoming a saver. The first step to anything is to just get started.

What are some ways you can change your mind frame to increase your savings, stop buying things you don’t need, and build an emergency fund?