When you are trading mutual funds the trading process is extremely simple. You enter in the fund symbol on the order page, the amount of money you want to invest, and click submit. At the end of the day after the market closes you then own a certain number of shares of the mutual fund as determined by that day’s closing price and the amount you wanted to invest. It’s so easy a caveman could do it if he had internet.

If you decide you want to dip your toe into investing in stocks and ETFs, the process is a bit more involved. It is easy for a newbie investor to get overloaded by all the options that you need to think about. Suddenly you are faced with things like market orders, limit orders, time-in-force, and more that you need to think about when all you want to do is buy a few shares of Starbucks.

On this post, I’m going to explain the various options that you will likely come across on the stock order placement page, what they do, and some things you will want to think about when buying a stock for the first time.

I will be using TD Ameritrade in my examples. You will find there might be minor variations in the terminology if you use a different online broker.

Table of Contents

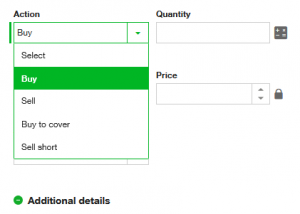

Buy, Sell, Buy to cover, Sell short?

The conventional way to make money in the stock market is to buy low and sell high.

You buy a stock at a certain price. Wait for the price to go up. Then sell it for a profit. This is known as going long on a stock. The timeframe for someone to own a stock before it’s sold can be seconds to even decades.

When you want to go long on a stock, you will choose the buy option when you place your order. When you decide you no longer want to own the stock, you will select sell.

Sounds simple enough, right?

Another way someone can make money in the stock market is by buying high and selling low. This is called going short.

Why an investor would want to short a stock is because they believe the stock price will fall soon. This could be because of upcoming bad news or if the company is overvalued.

Or you could be like me where almost every time I buy a stock, it falls soon after!

How shorting a stock works is you are borrowing shares of a security from a broker and buying them back later for less money.

To short a stock you will choose the sell short parameter.

While the position is open, you are paying interest to the brokerage on the value of the borrowed shares. You are paying interest because remember you are borrowing shares of stock.

When you decide you want to close out your position, you will buy to cover.

Types of Orders

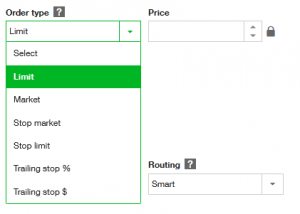

The most common types of orders are market, limit, and stop orders. For stop orders, there are stop market orders, stop limit orders, and trailing stop orders.

Market Orders

A market order is an order to sell or buy a stock immediately. The stock will be bought or sold immediately, but the price is not guaranteed. You are telling the exchange that you want to own that stock right now and you don’t care what price you pay.

Normally with a market order you will purchase the stock at the current ask for a buy order and at the current bid for a sell order.

There have been instances during a panic where a stock is experiencing extreme volatility because of bad news and traders who put in a market sell order found their shares were sold for a big loss from the last-traded price. To avoid this my recommendation is to use limit orders when possible.

Limit Orders

A limit order is an order to buy or sell a stock at a certain price or better. When you use a buy limit order, the order will only execute at the limit price or lower. A sell limit order executes at the limit price or higher.

For example, let’s say you wish to buy a stock for $10 and you place a limit buy order. Your order will execute when the price is $10 or less.

Stop Orders

A stop order, also called a stop-loss order is an order to close out a position when the price moves past a certain point. These are placed to lock in a profit or prevent excessive losses.

Even the best investors might hesitate to exit a trade when they are losing money, thinking the price might go back up. By using a stop order, the exit price is decided ahead of time.

Stop orders can also be used when an investor goes on vacation or is unable to monitor their stock portfolio as often.

A normal stop order is also called a market stop order. When the stock reaches the stop price it becomes a market order. This means the order may not exactly fill when it reaches the stop price. Sometimes in the morning the stock gaps down on open and triggers the stop. The executed price then may be significantly lower than the desired price.

The other type of stop order is a stop limit order. With this type when the price hits the stop price, the order becomes a limit order.

To help protect your trading gains, a trailing stop order can be used. A trailing stop sets the stop price at a fixed amount or percentage beneath the market price. As stock price moves up, so will the stop price.

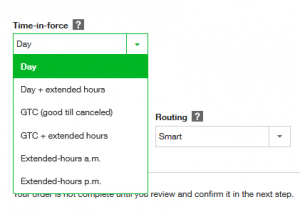

Time In Force

Time in force is an instruction informing the brokerage when an order should be executed. There are several types of time in force orders:

Day Orders

The default time in force parameter for most brokerages is day orders. When a day order is not executed, the order will expire at the end of the current trading day.

Day orders help prevent trades from executing accidentally if you forget to cancel them.

Good Til Canceled Orders

Good-Til-Canceled (GTC) orders stay active until two things happen – either you cancel the order or the trade is executed.

Many traders use limit and stop orders to set a price when to buy or sell a stock. By combining these with a good-til-cancel directive, your order will be executed when the stock hits your desired price even if several weeks go by.

GTC orders allow you trade stocks without constantly watching stock prices. Or maybe you want to buy a particular stock when it hits a certain price.

Contrary to the name, good-til-cancel orders do not remain active indefinitely. Brokerages set GTC orders to expire 30 to 90 days after to avoid a long forgotten order from executing unexpectedly.

Good Til Date Orders

A good-til-date (GTD) order is similar to a GTC order except it is active until a particular date. If the order is not filled or canceled by you before the date, it will automatically expire on this date.

Extended Hours Trading

Both the New York Stock Exchange (NYSE) and Nasdaq are normally open between 9:30 AM and 4:00 PM Eastern Time. Investors are also able to trade before the market opens and after they close through electronic exchanges.

After-hours trading usually occurs during 4:00 PM to 8:00 PM. Pre-market hours depends on the exchange and trading starts anywhere from 4:00 AM to 7:00 AM.

Because of lower liquidity, wider spreads between the bid and ask prices, and higher price volatility during pre-market and after-hours trading, there are increased risks with trading during extended sessions. Therefore you have to opt-in to extended hours trading by selecting the option.

You can set your order to be available for extended hours trading by selecting the “extended” option like in the above example with Ameritrade. Some brokers may have it listed as Day+, GTC+, and GTD+, which means day order plus extended hours, good til canceled plus extended hours, and good til date plus extended hours.

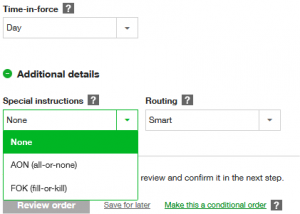

Other Conditional Instructions

Fill-Or-Kill

A fill-or-kill (FOK) order is an instruction that tells the brokerage that a transaction must be executed immediately and in its entirety or not at all. If the order is not executed it will be canceled or killed.

Fill-or-kill orders are typically used by day traders for buying or selling large quantities of stock within a short duration.

FOK orders do not allow partial executions.

Immediate-Or-Cancel

The immediate-or-cancel (IOC) instruction states that an order must be filled immediately at the limit price or better. The entire order or a part of the order may be executed.

If there is a partial execution of an order, the unfilled portion that is not immediately completed will be canceled.

An IOC order differs from a FOK order in that the IOC allows partial orders and the FOK does not.

All-Or-None

An all-or-none (AON) order is an instruction for the broker to fill an entire order or do not execute it at all.

By adding the all-or-none instruction your order will only execute if there are enough shares of stock available at your desired price. This avoids partial fills where you end up with only 20 shares executed out of order for 1000 shares – which has happened to me before.

What separates an AON order from a FOK or IOC order is the all-or-none order will not be canceled if it does not execute immediately. AON orders can be used with day or good-til-canceled orders so they will expire when the deadline passes.

Closing $ense

Knowing what each trade type and condition does and when to use them is often a good idea.

When starting out as a beginner trader, I recommend using limit orders combined with a good-til-cancel and all-or-none. This way there are no surprises to the price or number of shares on a trade.

Mutual funds and index funds are often an good choice when we are busy and don’t have enough time to dedicate to detailed stock analysis and research, and would rather someone else to manage the active trading for us.

But knowing how to perform a stock trade and picking your own stocks is a good tool to have in your quiver to managing your finances.

Do you trade your own stocks? What types of orders do you prefer? Do you have any recommendations on when to use what order type and trade expiration?