Humans are a flawed species, especially when there is a lot of money on the line. When investing, we’ve all the heard of the mantra to buy low and sell high. Yet we hesitate to buy when the markets are down because of the fear of losing money. When the markets are doing well, we hesitate to sell and lock in profits because we get greedy and fear missing out on future gains. This situation is also similar on the flip side of things. Rather than dump a losing investment, we hold onto it in hopes it will go back up. We also hesitate to buy in a bull market when stocks are soaring because we fear that we are buying at the top.

For the common investor, who may be a bit too preoccupied with work, family, and life in general, they may want to leave the investing of their retirement and brokerage accounts to the investment professionals with the idea that they know what they are doing. After all, if you need electrical work or open-heart surgery, you are going to want to get an electrician or a surgeon.

For most people, professionally managed investing means buying mutual funds. For the wealthy, this may mean getting access to hedge funds, the exclusive investment vehicle available only to qualified investors. For outsiders looking in, hedge funds are how the rich get richer.

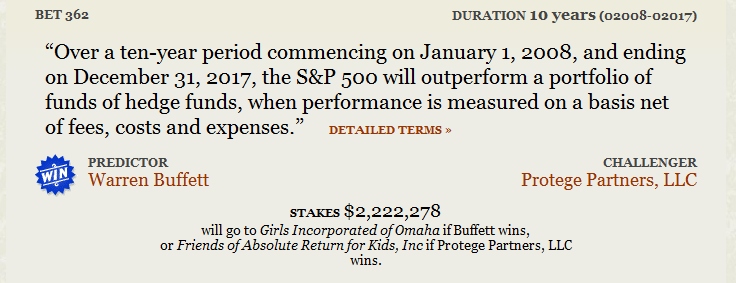

In 2005, what is possibly the greatest investor of all time, Warren Buffett offered to make a $1,000,000 bet with anyone that over ten years, a boring; low cost; passively managed S&P 500 index fund will outperform any collection of hedge funds. Buffett did not have any takers for his wager until July 2007, when Ted Seides of the investment firm Protégé Partners stepped up and accepted the challenge.

Both sides put up approximately $320,000 each into U.S. Treasury bonds, which would have grown to $1 million in ten years with the proceeds going to charity. The bet was made official and of public record at http://www.longbets.org/362.

Seides argued that because hedge funds have the ability to invest both long and short, hedge funds’

success can mean outperforming the market in lean times, while underperforming in the best of times. Through a cycle, nevertheless, top hedge fund managers have surpassed market returns net of all fees, while assuming less risk as well. We believe such results will continue.

Protégé Partners picked five “funds-of-funds”, that it expected to outperform the S&P 500. Those five funds had interests in over 200 hedge funds, all of which were managed presumably by the best of the best investment experts. Seides and Protégé Partners were confident they had an 85% chance of winning, even with the hedge funds’ management fees, the 20% fee of any gains that hedge funds usually collect, and the extra level of fees the funds-of-funds charges, all taken into account.

Buffett picked Vanguard’s 500 Index Admiral Shares (VFIAX) with its extremely low 0.04% expense ratio.

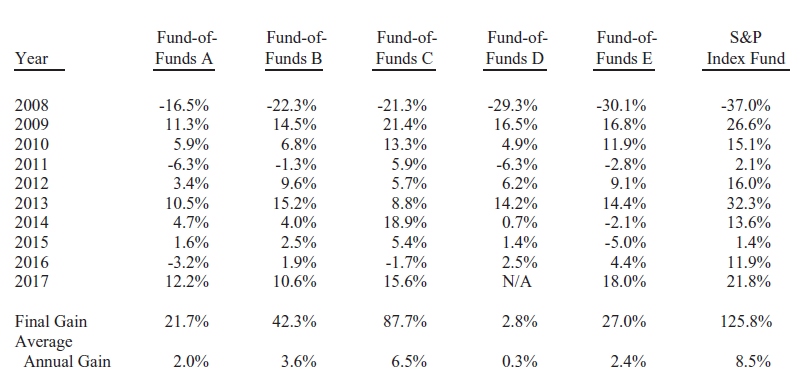

Immediately upon commencement of the bet, we had the Great Recession. By the end of 2008, the S&P 500 was down 37% while Protégé was down 23.9%, a 13% difference. Seides’s prediction appears to be on the money, with the hedge funds outperforming the market on lean times. Looks like Buffett has some catching up to do.

As the economy emerged from the recession, the S&P 500 slowly gained ground on the hedge funds. By 2012, five years into the bet, the S&P finally overtook Protégé. And the S&P kept on going, expanding its lead from the hedge funds. By the end of 2017 and the conclusion of the bet, S&P was the clear winner with the hedge funds’ performance failing to exceed the index fund nine out of the ten years.

Looking at the above table from Buffett’s letter to Berkshire Hathaway shareholders for 2017, the S&P 500 index average annual gain was 8.5% vs 2.96% for the five funds-of-funds. The S&P 500 had gained 125.8% vs 36.3% for the hedge funds over the 10 years. Even if we removed Funds-of-Funds D from the results, the average final gain would only be 44.68%, over 2.8x less than the S&P 500. Not one of the funds-of-funds managed to beat the index fund.

What this shows is that if $1 million was invested in the index fund and the hedge fund, the hedge fund would have gained $363,000. The index fund meanwhile would have a gained $1,258,000.

The story is similar with mutual funds. According to Marketwatch, over the last 15 years, 92.2% of large-cap funds, 95.4% of mid-cap funds, and 93.2% of small-cap funds failed to beat the S&P 500 index. That comes out to about 1 in 20 mutual funds being able to beat the index.

Looking at past performance is never a guarantee that a particular mutual fund will continue to do well either. Remember that fund managers are human and therefore not infallible from making bad, misguided, or simply unlucky decisions.

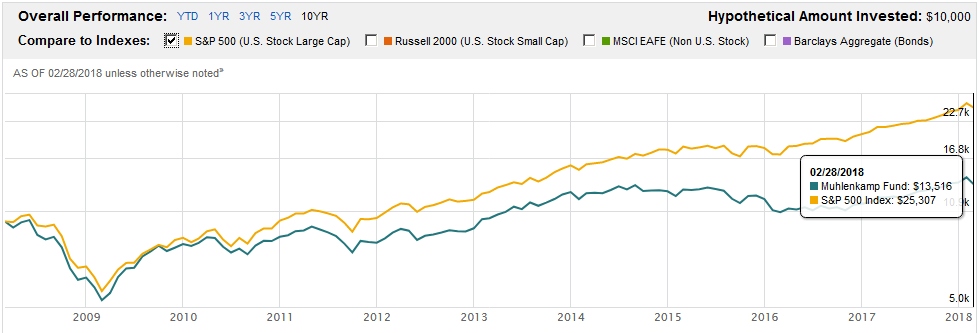

Case in point, I owned the Muhlenkamp Fund, which was praised by Kiplinger in 2007 for returning an annualized 13% over the past ten years. Fast-forward to today and $10k invested in a S&P 500 index fund over the last ten years would be worth over $25k while Muhlenkamp is worth just $13.5k.

For most mutual funds, in addition to failing to beat the S&P 500 index, you are paying many times more in fees – over 30 times more on average. The Investment Company Institute’s 2017 Fact Book found that the median equity mutual fund expense ratio was 1.21%. Compare that to Vanguard VFIAX’s 0.04%. An account with $1 million in mutual funds will pay over $12,100 in fees a year alone compared to just $400 for the index fund.

Closing $ense

Actively managed funds already have their work cut out for them to beat the market, and these funds are led by full-time professionals with years of experience with teams of analysts doing research on the best investments. High management fees raises the bar even higher. In this challenge of hedge funds versus index fund, it was slow and boring against some of the best and brightest in the finance industry. Warren Buffett literally put his money where his mouth is… and won.