For 2019, the average monthly Social Security benefits for all retired workers was $1,461. Do you think you will be able to live on about $1,500 a month?

Now consider that Social Security is expected to be insolvent by 2035 with only enough money to cover about 80% of its obligations. If your anticipated Social Security benefit was $1,500 in 2035, will you still be able to live comfortably on 80% of that or $1,200?

As if the Social Security situation isn’t bad enough, Medicare is expected to be insolvent even sooner, by 2026, if no changes are made by Congress to fix it.

With Social Security and Medicare being unable to meet its obligations by the time many of us reach retirement age, it is all the more important that we do our own saving for old age.

One of the best tools to save for retirement is with a 401k.

At some point, if you contributed regularly into a 401k, your 401k will be the largest income-producing asset you will have that will keep sending you monthly checks for many years after you’ve stopped working.

Table of Contents

Common Mistakes People Make With Their 401k

To avoid having to eat ramen every day in retirement, here are the most common 401k mistakes you should avoid.

Not Saving Into a 401k at All

It’s all too easy for us to say we have plenty of time to save for retirement and to put it off until later. After all, there are vacation selfies at Machu Picchu that needs to be taken.

When you are younger, the biggest advantage you have is time. The sooner you plant your retirement money tree, the more time it has to grow. Play around with our compound interest calculator to see how fast your savings can grow the earlier you start.

Read more: Become a millionaire by saving less than $10 a day

Pew Charitable Trusts found that only 52% of millennials take advantage of defined contribution plans when offered by their job.

Uncle Sam encourages you to save for retirement by not taxing the contributions you make into your 401k so you will have more money available to grow and compound faster.

Many employers encourage you to contribute into a 401k by matching your contributions with their own money up to a certain percentage of your salary.

Once you’ve set it up, your 401k will be automatically funded from your earnings and invested with your chosen investments. There is not much left for you to do after that.

Missing Out on the 401k Employer Match

As already mentioned, many employers will match your contributions either dollar for dollar or 50 cents per dollar up to a percentage of your total salary. Typically, the match percentage is anywhere from 3 to 6 percent of your pay.

The employer match is basically free money. If you saved 6% of your salary and your employer matched it with the full 6%, you’ve gotten a 100% ROI before even investing a cent.

Sticking With the Default Savings Rate

Many companies now automatically enroll new and sometimes existing employees into a 401k and default to investing 3% of their pay. While this is better than nothing, this is still much too low. According to Vanguard, the average 401k savings rate was 6.8% of pay in 2017.

The Bureau of Labor Statistics found the median wage for workers in the first quarter of 2019 was $905 per week or $47,060 per year. A 3% contribution is just $1,412 a year.

Some employers now automatically increase the contribution percentage by 1% each year to combat the low default savings rate. If your employer does this you should take advantage of it. Another way to increase your contribution rate is to save some or most of your annual bonuses and raises.

At the very least you should contribute enough to get the full match.

Investing Your Entire 401k in Target Date Funds

According to Fidelity Investments, in the first quarter of 2019, more than half of 401k participants, including 68% of millennials have 100% of their assets invested in target-date funds. 98% of employers offer target date funds and 89% of them offer them as the default investment option.

You can distinguish which mutual funds are target-date funds by looking for funds with a year in their name. The year signifies when you plan to retire.

Target-date funds are thought to be the perfect option for the people who want to “set it and forget it”. As the years go by the fund will automatically rebalance itself from aggressive to more conservative so you have the optimal allocation of bonds versus equities for your age.

Target-date funds aren’t inherently bad. Investing in them is better than your 401k contributions sitting in cash and getting eroded by inflation.

The problem with target-date funds is the cost of being lazy. Target-date funds have higher fees and weaker performance than other investments you can choose. A one size fit all fund may not be an ideal fit for all employees.

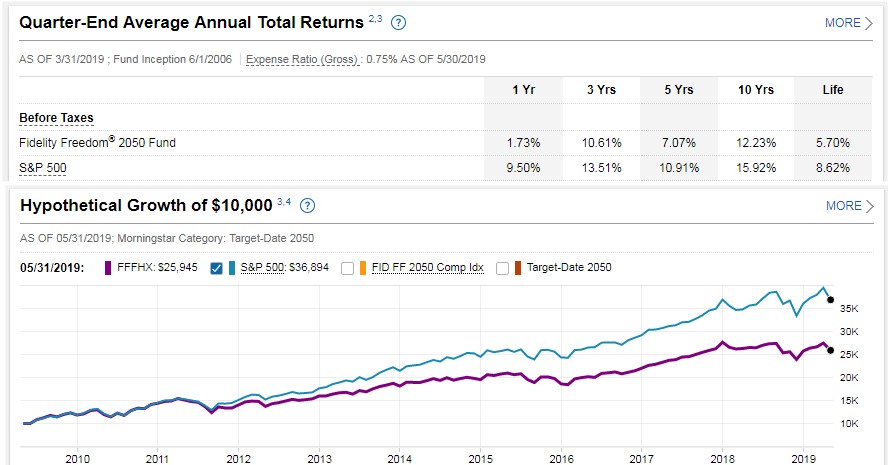

Take for example the Fidelity Freedom 2050 Fund (FFFHX). The expense ratio is 0.75% and the 1-year return as of 5/30/2019 is 1.73% compared to 9.50% for the S&P 500. Since the fund was established in 2006, its total return was 5.70% versus 8.62% for the S&P 500.

Should your 401k plan offer it, you can create a diversified portfolio yourself with just three funds – a total market or S&P 500 index fund, an international stock index fund, and a bond index fund. Often recommended by Bogleheads, a portfolio with only three funds is extremely simple to manage. You just need to login once a year and rebalance as necessary. Using index funds means extremely low costs. There are even funds with zero expense ratios if you happen to invest at Fidelity.

Borrowing From Your 401k

Borrowing from your 401k is a huge no-no. This is why you should have an emergency fund handy. Your 401k should be the absolute last resort if you need money.

The reason you should not borrow from your 401k is:

- Lost of market gains – When you take out a loan from your 401k, your money isn’t invested and earning you more money.

- You risk owing penalties and taxes – If you are unable to pay back your 401k loan in time, the money you withdrew and haven’t paid back is considered a distribution. You will then owe income taxes on the withdrawal plus a 10% penalty.

- Loan can come due sooner than expected – Should you change jobs or get laid off, a 401k loan becomes due by the due date of your federal tax return, plus any extensions. Unless you know you will be at your current job for the duration of the loan, taking a loan from your 401k can be risky.

As if the other three points aren’t bad enough, you are also paying interest on money that was yours anyways.

Cashing Out Your 401k When You Change Jobs

It’s rare in this day and age for someone to work for one company their entire career. Should you decide to leave your job, you should never cash out your 401k, even if there isn’t much money in the account.

Cashing out your 401k before you are 59.5 years old means you will pay those taxes and penalties same as if you had taken out a loan and didn’t pay it back in time.

What you should do instead is roll it over into an IRA. You get the same tax benefits with an IRA as a 401k, while having a wider range of investment options. You are no longer stuck with a limited selection of funds. You can open an IRA anywhere, from discount brokerages like E-Trade and TD Ameritrade to investment companies like Vanguard or Fidelity and invest in stocks, bonds, ETFs, mutual funds, and more.

Ignoring (or Forgetting) Your Old 401k Plans

This is the opposite of cashing out your 401k when you leave a job. Instead you leave orphaned retirement accounts scattered across all your former employers. This might make sense if there are good investment options with low costs or company stock.

For most people consolidating your old accounts into a rollover IRA means simpler management. It’s easier to keep up with one big account than dozens of accounts with a few thousand dollars spread across different employers. As time passes, companies merge; logins get lost; management and fees change.

You don’t want to be 60 years old and trying to find out what happened to an account from three decades ago.

Forgetting to Take Your 401k Distributions

You can start making penalty-free withdrawals from your 401k at 59.5.

You can also delay taking distributions from your 401k if you have other income sources available. However, once you turn 70.5 years old, you must start taking annual distributions.

Failure to take a Required Minimum Distribution (RMD) by the annual deadline means a tax penalty of 50% of the amount not withdrawn.

Don’t give more money to the government than you need to. Keep on top of your RMD’s. Once you turn 60, take a look at your current income and do the math to see if you should start taking distributions then to space out your tax bill and maybe even pay taxes at a lower tax rate.

Market Timing Your 401k Investments

There are stories of people who panicked during the Great Recession and sold all their investments and sat out the stock market downturn only to miss out on the turnaround.

Your 401k is a long-term investment. As long as you stay the course you will come out fine.

Thanks to periodic contributions from each paycheck, your 401k has dollar cost averaging built-in. Your plan will continue to purchase shares no matter if the market is up or if the market is down at each pay period.

Owning Too Much Company Stock

It can be tempting when your company has an employee stock purchase plan for you to buy shares of their stock at a bargain. However, loading up on too much company stock can jeopardize your retirement plans.

As an employee you might have an advantage from knowing how well your employer is doing. There is also a risk too. If the company encounters trouble you will not only lose your job and source of income, all your retirement savings invested in the company will take a hit too.

Even what may be large and safe companies can be affected as the business environment change. Take for example what happened to Worldcom, Enron, and more recently GE.

Not Taking Advantage of Catch-Up Contributions

Hopefully as you approach retirement age, your compensation increases with the years on the job.

To encourage saving for retirement as one approaches retirement age, the IRS allows individuals age 50 or over to make catch-up annual contributions to their 401k plans. If you already max out your 401k, you can contribute an additional $6,000 a year.

With mortgages, paying off your student loans, raising children, funding your kids’ college tuition, and paying for life’s unexpected surprises, saving for retirement may end up on the back burner. The boost in savings from catch-up contributions can be what you need to reach your retirement goals.

Not Considering Other Options if Your Company Doesn’t Have a 401k

One of my friend works for a company that offers a good salary and benefits, but there isn’t a 401k available.

Just because there isn’t a 401k or other kind of defined benefit plan doesn’t mean you should ignore saving for retirement and the future. Explore what other options are available for you to take advantage of.

Consider opening a traditional IRA, a HSA if you have a qualifying high-deductible health plan, or a Roth IRA to make after-tax contributions. You can even consider a permanent life insurance policy, where some of your premiums go into an account that builds cash value that you can borrow or withdraw against.

There is always the option of starting your own side hustle. With the earnings from your business, you can open a Solo 401k and save up to the maximum 401k contribution limit.

Closing $ense

401k’s are one of the best ways to save for retirement. As long as you avoid all these common 401k mistakes and stay the course, your retirement should be just fine.

Not only does saving in a 401k reduce your taxes, the money comes out of your paycheck before you see it. This is the true definition of paying yourself first. After you’ve initially set your contributions and investments up, most of your retirement saving will be automated and there won’t be much to do but to rebalance your investments occasionally.

These mistakes might make it seem like 401k accounts are more trouble than they are worth. They are still better than the alternative of having to depend on Social Security alone. It could mean a retirement of leisure and travel or not being able to retire at all.

Do you know any other mistakes to avoid with a 401k?