I recently retrieved my American Express EveryDay credit card from my desk drawer to put a $4 charge on it after not using it for over 15 months. The reason? To keep the card active so Amex doesn’t close the account for inactivity.

Many people may wonder whether it would be a good idea to cancel a credit card they aren’t using regularly. In most cases, keeping a credit card account open will help your credit score. However, there are still a few situations where you may want to cancel a credit card:

- Your credit card has an annual fee

- You have trouble managing your spending

- You are getting separated or divorced

- You want to avoid unauthorized charges

Table of Contents

How An Old Credit Card Can Help Your Credit Score

It might not seem to make any sense to keep an unused credit card around, but closing a credit card can actually lower your credit score due to the scoring factors in the FICO model. Two of the factors that go into calculating your credit score is the credit utilization ratio and the length of your credit history. Combined, these two components make up 45% or almost half of how your credit score is calculated.

Closing A Credit Card Can Increase Your Credit Utilization

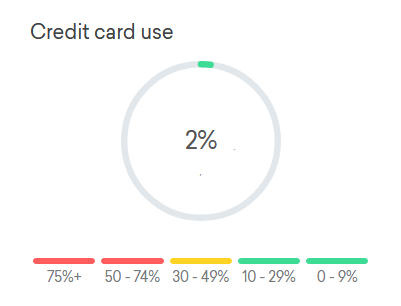

Your credit utilization ratio makes up 30% of your credit score. It is calculated by taking your current credit card balance divided by the total amount of credit available to you. The lower the percentage of credit being used the better. Credit bureaus want to see credit being used responsibly and using too much of your available credit might mean you are having financial difficulties.

Most personal finance experts and Credit Karma will tell you that you should keep your credit utilization ratio to no more than 30%.

Let’s say you have two credit cards. One has a credit limit of $6,000 and the other has a limit of $4,000 for a total of $10,000 in credit. You currently have $3,000 charged to the first card, making your total credit utilization rate 30%. You then decide you want to get out of credit card debt, so you close your $4,000 card to avoid temptation. Your percentage of credit used is now $3,000 out of $6,000 or 50%.

Often times when you see an immediate drop in your credit score after closing a card, it is from your credit ratio increasing. The total credit available to you is reported monthly to the credit agencies.

Before closing a credit card, take a moment to see how it will affect your credit utilization ratio. A card with a smaller credit limit will likely have a smaller impact on your credit score.

In my case, my American Express card has the highest amount of credit of all my credit cards, making up almost 50% of my total credit. Therefore, it will be advantageous for me to keep the account active even though I don’t regularly use the card.

Canceling A Credit Card Can Decrease Your Credit History Length

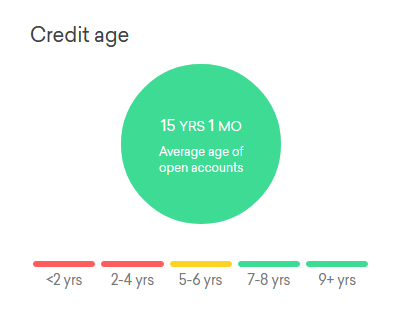

The next factor of your credit score that can be affected by closing an unused credit card is the average age of your credit history. This factor makes up 15% of your FICO credit score.

Assuming age results in more wisdom in one’s life, credit agencies make the same assumption with credit history. The longer the length of your credit history, the more experience you should have with credit and how to use it wisely.

However, instead of counting the total number of years you’ve had credit, the credit reporting agencies take the average age of your accounts. The reason for this is because opening up a lot of new credit cards or applying for lots of new loans could mean you are having money trouble.

If you have three credit cards that are 1 year, 2 years, and 12 years old, the average age of your accounts is 5 years. Closing the 12-year-old card won’t immediately cause a drop in the length of your credit history and in turn, your credit score. The closed card will still stay on your report for 7-10 years while the other cards age. If the closed account falls off your report in 7 years, the average age of your remaining cards will be 8 years vs 11.6 years if you had kept your oldest account open.

Other types of accounts such as auto loans, mortgages, and student loans will still be considered in the length of your credit history. But when you have higher interest loans, it is better to pay them off as quickly as possible to save on interest payments. Except for credit cards with annual fees, there are no additional costs or interest to keep an older card open.

To get a perfect credit score, free credit score site Credit Karma wants to see an average credit age of 9+ years

Credit length is the other reason why I make it a point to use my American Express occasionally to keep it active. I’ve had the card for over 21 years and it is my oldest account.

When To Get Rid Of An Unused Credit Card

There are a few situations when keeping an old credit card active can come back to bite you. Here are a few situations where it makes sense to close that unused card:

Your Credit Card Has An Annual Fee

Many credit cards that offer high-end rewards and signup bonuses also come with a hefty annual fee for being a cardmember. Perhaps you were traveling a lot for work and you got the card for the extra travel perks such as access to airport lounges and frequent flyer miles.

If your needs have changed and you are no longer using the card regularly, continuing to pay the annual fee is a waste of money. Do the math to see if the value of the rewards you are getting back is exceeding what you are paying in annual fees. If the answer is no, call the issuer to see if they will waive the annual fee if you keep your account open. Otherwise, close the account.

You Have Trouble Controlling Your Spending

If you can’t keep yourself from overspending, you shouldn’t have a credit card. Period. Adding more and more new purchases to your card when you should be paying off the balance in full every month is only putting yourself deeper into debt that will take longer and longer to pay off as the high interest, late fees, and over-the-limit penalties work against you.

Thanks to the CARD Act, your credit card company now clearly lists how long it will take for you to pay off your balance if you make the minimum monthly payment. A $1,000 balance can take over 4 years to pay off if you only pay the $25 minimum amount.

As your credit utilization ratio goes up from impulsive spending, it will negate any benefit the card will provide towards your credit score. This is more so the case if you start missing payments. So cancel the card even if you haven’t paid off the balance yet. You will be able to still pay off what you owe on the card even when you won’t be able to make new charges on it.

You Are Getting Separated Or Divorced

Maybe you are separating or getting divorced from someone who shares a joint account with you. As long as they are an authorized user on the card, they will be able to run up charges on the card. The credit card issuer will hold both parties responsible for the bill.

Just as if you had put your child as an authorized user, you will be jointly responsible for the charges your ex-partner charged to the card. Should your ex refuse to pay off their bill, the issuer will come after you for payment even if the divorce decree states what will happen with credit card debt. Credit card companies only care that they are getting their money. You will be left heading back to divorce court to try to get the money from your ex.

Close your joint credit cards in a divorce and each party should open individual cards in their own names.

You Want To Avoid Fraudulent Charges

When you have credit cards that you do not use, the smart thing to do is to leave them at home and not in your wallet. This doesn’t mean you can skip checking your monthly statements for your cards though.

Credit cards can still go missing if they are not kept in a secure place when you have roommates or people such as contractors or service people entering and leaving your home.

You aren’t safe if you keep your credit card locked up or in a safe deposit box either. With all the news about retailers, websites, and even credit bureaus such as Equifax getting hacked, your information is in a database somewhere if you’ve ever used the card even once.

The only foolproof way to avoid unauthorized charges is to cancel unneeded credit cards.

Closing $ense

Keeping credit card accounts open can help with building or maintaining your credit. This is even more important if you are planning to apply for a loan or mortgage in the near future.

When closing an account, take into consideration how your credit limits and the overall age of your accounts will be affected. While keeping dormant accounts open may help your credit score, none of that matters if having a credit card tempts you to get into debt, costs you money in the form of annual fees, or increases the possibility and hassle of you ending up with unauthorized charges.

Ultimately, you will need to look at the situation as it applies to you and make the best choice for yourself.

How do you feel about old credit cards? Should you keep them or close the account?