A virtual credit card can reduce some of the worries about fraud and your credit card number being stolen in a data breach or used by an untrustworthy merchant when using your credit card online.

Here is why I generate a unique virtual credit card for every vendor I do business with on the internet and why you should do the same.

Table of Contents

What Is a Virtual Credit Card Number

A virtual credit card number is a temporary 16-digit number with an accompanying security code and expiration date that can be used in place of your actual credit card number.

Rather than giving out your credit card number for use online or over the phone, you can provide the merchant this virtual credit card number instead.

The issuer of your virtual credit card will often have options for you to limit the use of a virtual credit card to a particular merchant, lock or delete the number to prevent unauthorized charges, and set spending limits or specific expiration dates.

All the transactions on your virtual credit card will be attributed to the credit card account under which it was created.

Where to Get a Virtual Card Number

Virtual credit cards have been around for years, but not every credit card issuer offers them. The two major issuers that currently offer consumer virtual card numbers are Capital One and Citi.

American Express currently does not have a virtual card feature for their personal cards. Businesses can create virtual cards for their employees on the American Express Go portal.

Discover used to offer virtual account numbers but discontinued the feature a few years ago.

Capital One Virtual Cards

Capital One members can create virtual credit cards in two ways – online on the Capital One website or using Eno, their online assistant.

To generate a virtual number on the Capital One website, you will need to log in to your dashboard.

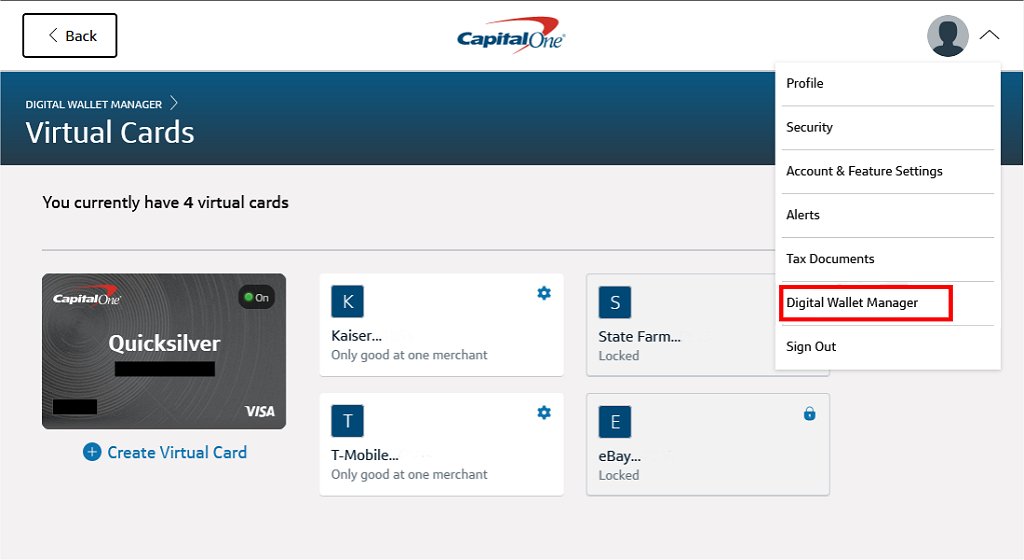

Then click on your profile image at the top right of the screen and look for the “Digital Wallet Manager” in the menu.

Next, click on “Manage your Virtual Cards”.

Available options when configuring a virtual card include assigning a name to the card for easy reference, manually locking the card to prevent any new charges from being made, scheduling a date to automatically lock the card, and a link to delete the virtual card.

When you install the Eno browser extension and link your Capital One card with it, Eno will offer to generate a virtual card number when you checkout online. Afterward, you can manage your virtual card numbers on the Capital One website as usual.

The Capital One virtual card is only good at one merchant and the expiration date is for 5 years from the date of creation.

Citi Virtual Account Number

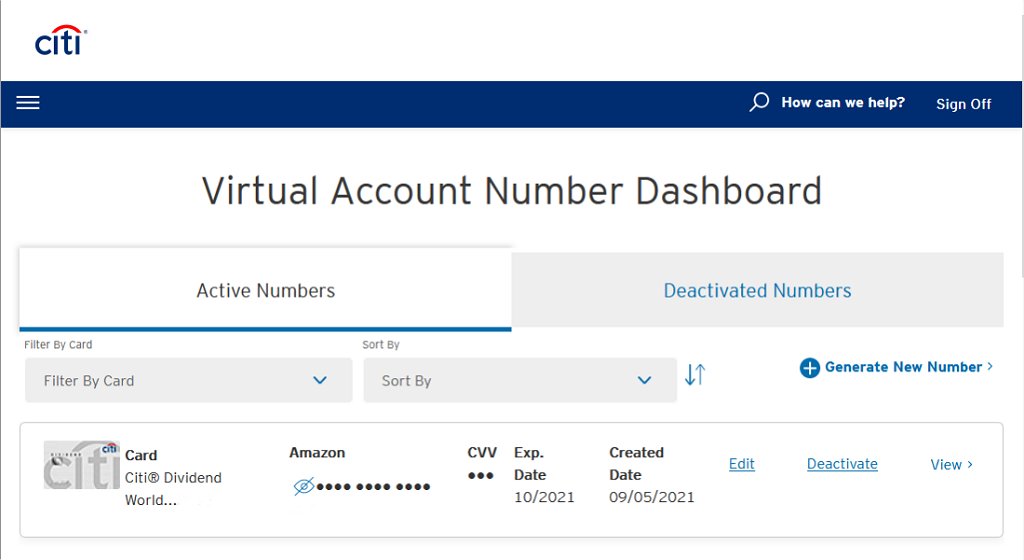

Citi recently re-vamped its virtual account number feature in September 2021.

Citi states that the virtual account number benefit may not be available to all Citi cards. To see whether your card is eligible to create a virtual card number, you will need to log in to the Citi website.

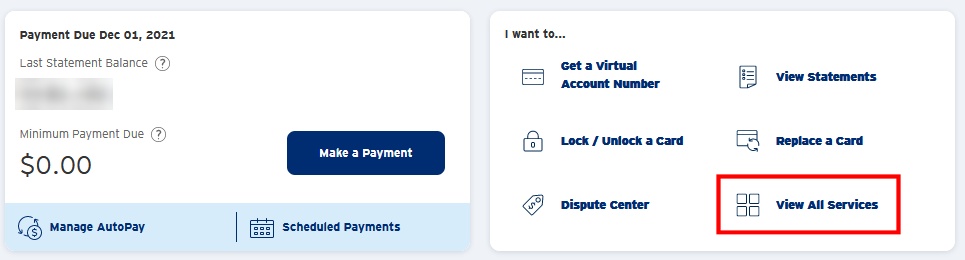

Look for the “View All Services” link next to the payment area on the Account Overview page.

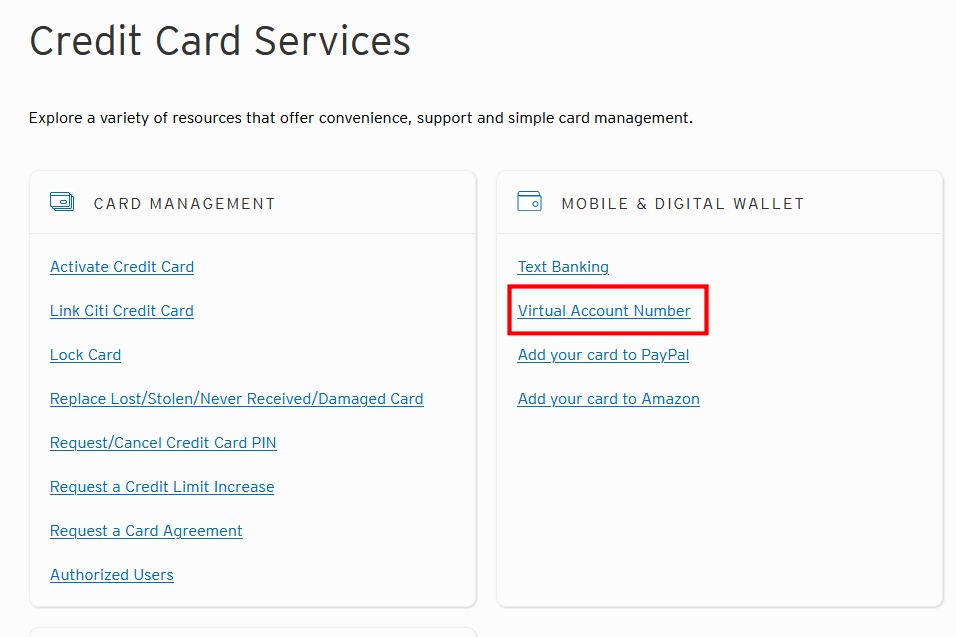

Clicking that will take you to the Credit Card Services page where you will find a link to the Virtual Account Number Dashboard under the Mobile & Digital Wallet section.

When you generate a new virtual number, you will first be asked to choose your credit card under which it will be created.

Next, you will set the timeframe your number will be active, from one month to up to two years. Finally, you have the option to set a daily spending limit.

Why Use a Virtual Credit Card

Fraud Prevention

It seems like not another week goes by that we do not hear about yet another major company having a data breach resulting in personal information being stolen.

A debit card is the worst method of paying for purchases when paying with plastic. In the event your debit card number gets stolen, you run the risk of a thief emptying out your bank account and leaving you to fight with your bank to get your money back while your checks and bills bounce.

A credit card is a little better. The Fair Credit Billing Act limits your liability from unauthorized use to $50. Many major credit card issuers offer $0 fraud liability to their cardholders. During the fraud investigation process, you may withhold payment on the disputed amount and related interest charges. With a credit card, you are never out of your money.

However, getting your credit card number stolen is still a major inconvenience. You will be unable to use your credit card while you wait for your issuer to mail you a new physical card. After you get your new card, you have to update your credit card info with all your recurring vendors for things like your gym membership to your NetFlix subscription.

A virtual credit card operates similarly to putting up silos. When you generate a new virtual credit number for each of your merchants, a data breach at one company will not affect your physical credit card or your other virtual credit card numbers. You can simply disable the compromised virtual credit card, create a new number, and continue on with your day.

In some cases, a virtual card number is locked to a specific merchant. Even if your number is stolen from T-Mobile, the hacker won’t be able to use your virtual number at Amazon.

Avoid Unauthorized Recurring Charges

Have you ever signed up for a trial subscription and forgot to cancel? Plenty of people have gotten bitten by monthly recurring memberships and gotten stuck with unwanted charges.

With a regular credit card, you run the risk of getting charged for years until your credit card expires.

You can limit these recurring charges by using a virtual credit card and setting your own expiration date. If you only want to join a service for one month, you can create a virtual card that expires after a month. Or you can log in to the issuer’s website and manually disable the card.

Once the virtual card is deactivated, the charge will be rejected when the merchant attempts to bill you for the next month.

Help with Budgeting or Limiting Spending

Have you heard the story about how a kid spent almost $3,000 on SpongeBob ice cream or the teen who spent $20,000 on Fortnite without their mother’s knowledge or permission?

When you use your normal credit card, your spending limit is your credit limit. If you added your credit card as your default payment method on the Apple Store or Amazon, you run the risk of unexpected charges or going over your budget if you are not careful. This is especially true if you let other people such as your kids use your phone or your account.

To avoid excessive charges, you can create a virtual account number with Citi and set a hard daily spending limit. Anything over the daily limit will result in the charge being declined.

I use this feature regularly for things such as monthly recurring payments that are not expected to change and for purchases when I don’t want to be overcharged.

Track Spending Habits

With Citi, virtual credit cards are similar to using a separate credit card to see how much you are spending with a particular merchant. This allows you to know exactly where your money is going.

On your monthly statement, Citi lists the virtual account number charged by the merchant.

Logging onto your Citi online account and going to the Virtual Account Number Dashboard, you can view all the dates and amounts charged by the merchant to that virtual card.

Drawbacks with Virtual Credit Cards

Virtual credit cards may sound like the ideal solution to most of the problems people worry about when using a credit card. It may be tempting to use them everywhere. However, there are some downsides to virtual credit cards.

The primary drawback is you can only use virtual credit card numbers for online, phone, and purchases where you do not need to present an actual credit card. You should not use a virtual credit card if you expect to show or swipe your card to complete your purchase. This may include online orders that you pick up in person, reservations, will-call ticket purchases, or for certain travel bookings such as car rentals, hotels, or flights.

Virtual account numbers are inconvenient. When checking out, anyone can pull out their physical credit card and type in the details immediately. A virtual card requires you to take time to log in to the issuer’s website and generate a number. Capital One, for example, will text you a code to verify it is really you before allowing you to create a number. From my experience, this code can sometimes take a while to arrive from Capital One.

They don’t work at brick-and-mortar stores. Most local stores expect you to swipe, tap, or insert your chip card to complete the transaction. One solution is to add your credit card to a digital wallet. As Google Pay, Apple Pay, and Samsung Pay become more widely accepted, you’ll be able to pay using your mobile phone without exposing your credit card info.

Other Considerations with Virtual Cards

Refunds and Returns to a Virtual Credit Card

One thing I’ve seen many people wrongly claim is that you can’t get refunds or credits back to your virtual credit card after it has expired.

Refunds and credits to virtual cards work the same way as refunds to regular credit cards that have expired. As long as you still have an account open with your issuer, the refund will appear on the account associated with your credit card under which the virtual number was generated.

You should keep your receipt or note which virtual card number you had used to make the purchase since merchants will not have your actual credit card number on file.

You Need to Keep Your Login Credentials Safe

Capital One and Citi will sometimes require you to verify your identity with a text or email before you can create a virtual credit card. Someone who gets your login to your credit card issuer’s website will literally have the keys to the bank vault.

Anyone with access to your online account can generate working virtual credit card numbers with accompanying CVV codes and expiration dates.

Closing $ense

People who are worried about keeping their credit card details safe when shopping online should consider using a virtual credit card.

It usually only takes a few extra minutes to create a virtual account number. With the ability to set up one-time use and virtual numbers that support recurring transactions, there is rarely a reason you should use your actual credit card number to shop online.

Even though you are not liable for fraud and unauthorized use when your credit card info gets stolen, it does take extra time to track down and update your credit card details at the different merchants. A little prevention beforehand will reduce your headache the next time a company you’ve done business with gets hacked.

Do you use virtual credit card numbers when you shop online? How do you use them? What are some of the features you like the most?

I’m a long time user of Citi’s virtual credit card numbers. To me, one of the main benefits of Citi’s virtual credit card numbers was that you could set a maximum spending limit on a virtual card number. So if you’re buying something from an online merchant that you’re unsure about, you could set a maximum spending limit on a virtual cc number to ensure you’re not overcharged.

But now Citi, in its September 2021 revamping, has eliminated the ability to set a maximum spending limit on a virtual number. Instead they replaced this with the ability to set a *daily* spending limit. In my opinion, this greatly reduces the usefulness of Citi’s virtual credit card numbers. To now be able to limit the amount that can be charged to a virtual number, you have to deactivate the card after its first use, to prevent the possibility of new charges every day up until the expiration date.

Perhaps the authors of this article could respond and state whether Capitol One’s virtual credit card numbers can be assigned a maximum spending limit.

I understand that one reason that so few banks offer virtual credit card number services is the existence of online payment services such as Click to Pay. But Click to Pay (and I assume other payment methods based on digital wallets) only works if a particular merchant accepts that payment method. That greatly limits their use.

Hi Bob,

You are right. The best feature of the previous Citi virtual numbers was being able to set a maximum/hard spending limit so that the merchant can’t overcharge you. I always rounded up the total amount and set a limit when I created a new number. Unfortunately, Citi replaced that with a daily spending limit, which isn’t as useful.

Capital One’s virtual card numbers don’t have the ability to set any kind of spending limit so stick with Citi if that feature is important to you. The only unique feature about Capital One’s is being able to schedule an automatic locking of the virtual number down to the day.