Are you thinking of closing a Citi credit card? Maybe you’ve taken advantage of some of the lucrative American Airline bonus miles that Citi was offering with the Aavantage Executive card and now you are facing a big annual fee for the next year. Or maybe you have too many cards in your wallet that your back is starting to hurt and you want to lighten the load.

Whatever your reason is for deciding to cancel your card, it does not have to be a hassle. You can avoid talking to a representative by going online and canceling through their website. Keep in mind that Citi does offer some generous retention offers such as waiving the annual fee or earning additional bonus points if you call.

If you don’t care about offers and want to cancel your card, keep reading for directions on how to cancel your Citi card via online, phone, or mail.

Table of Contents

Cancel Your Citi Credit Card Through The Internet

Want to cancel your account but hate the hoops you need to jump through to do it via telephone? Skip the 15 minute hold for the next available representative, the cheesy hold music, and being asked a half dozen times whether you are really sure you want to cancel your card by closing your account online.

You can cancel your account in less than 5 minutes by following these steps:

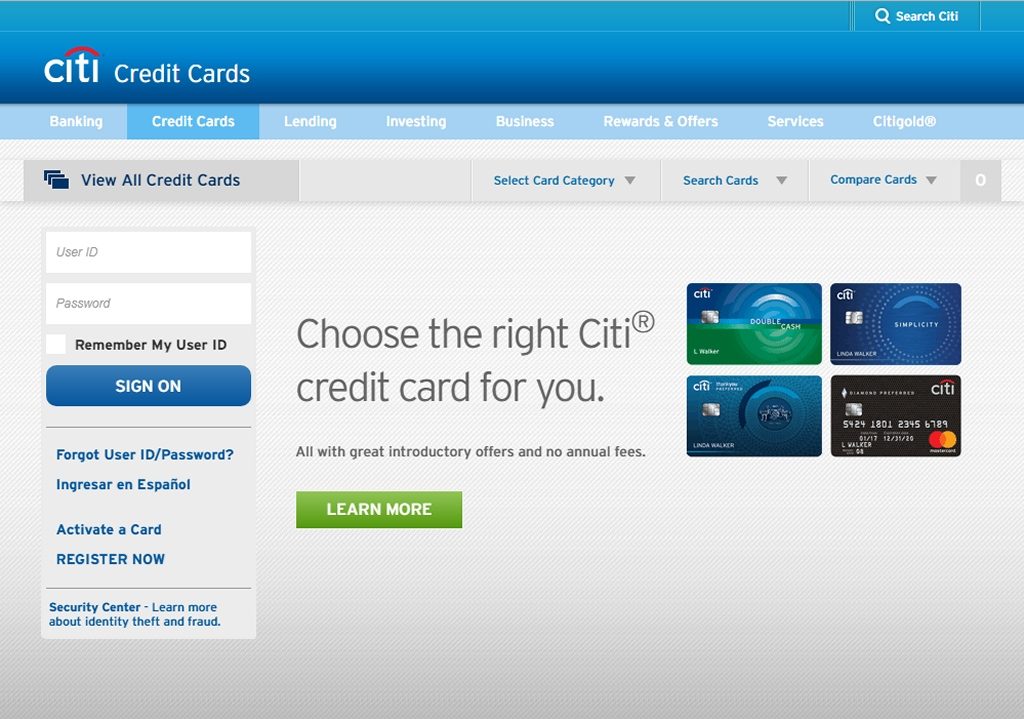

1. Log in to the your Citi account by going to Citicards.com and entering your user ID and password

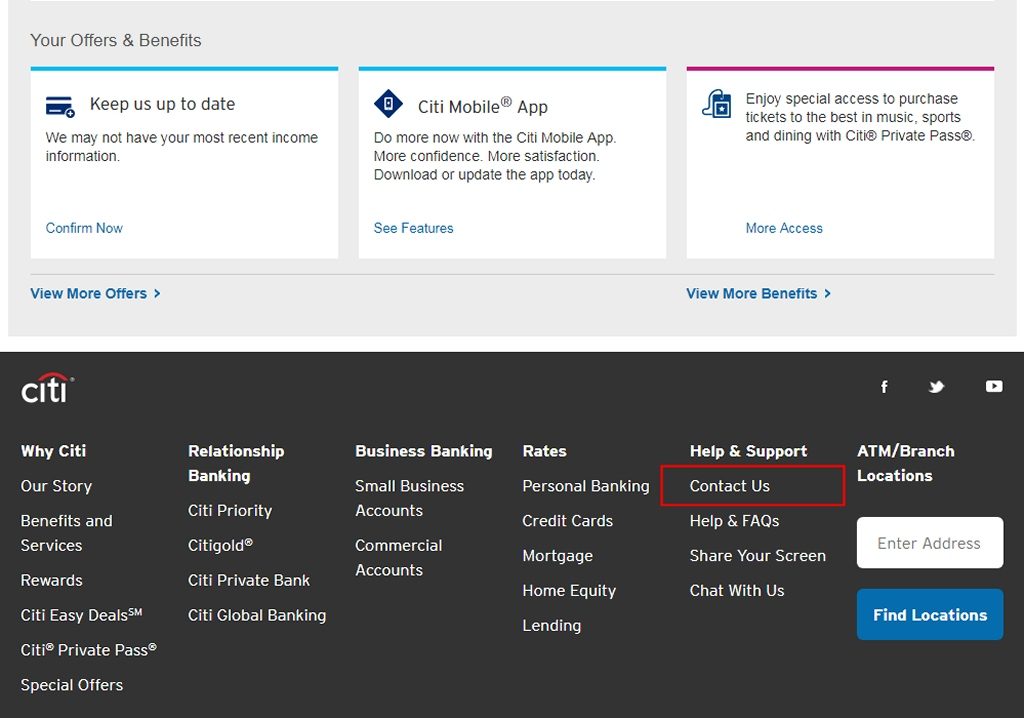

2. Scroll down to the bottom of your account dashboard page and click Contact Us

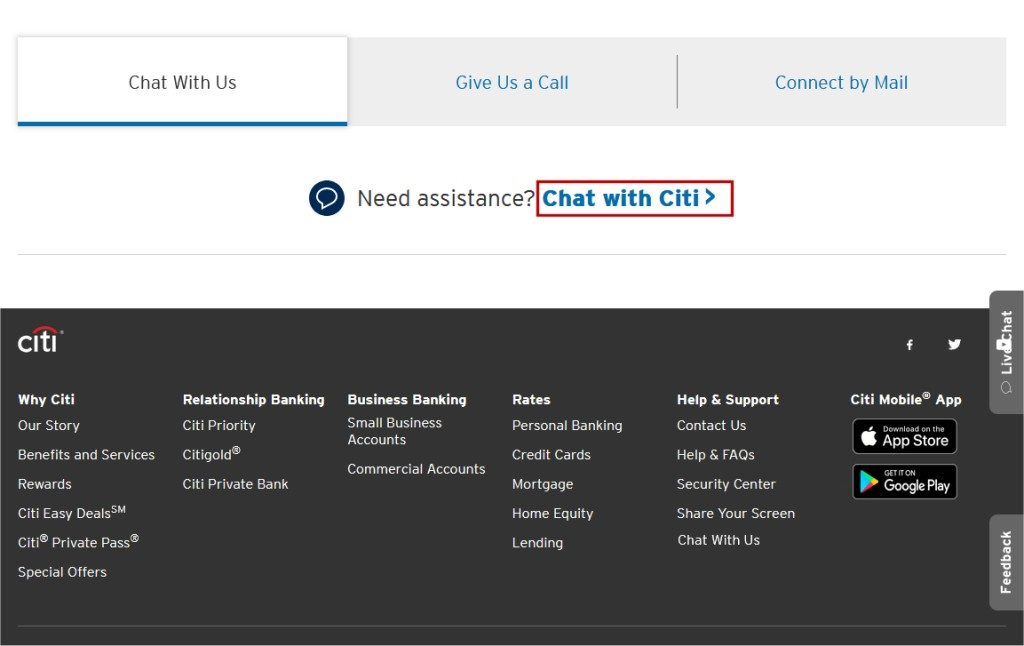

3. On the Contact Us page, scroll down and click the link to the Chat With Citi

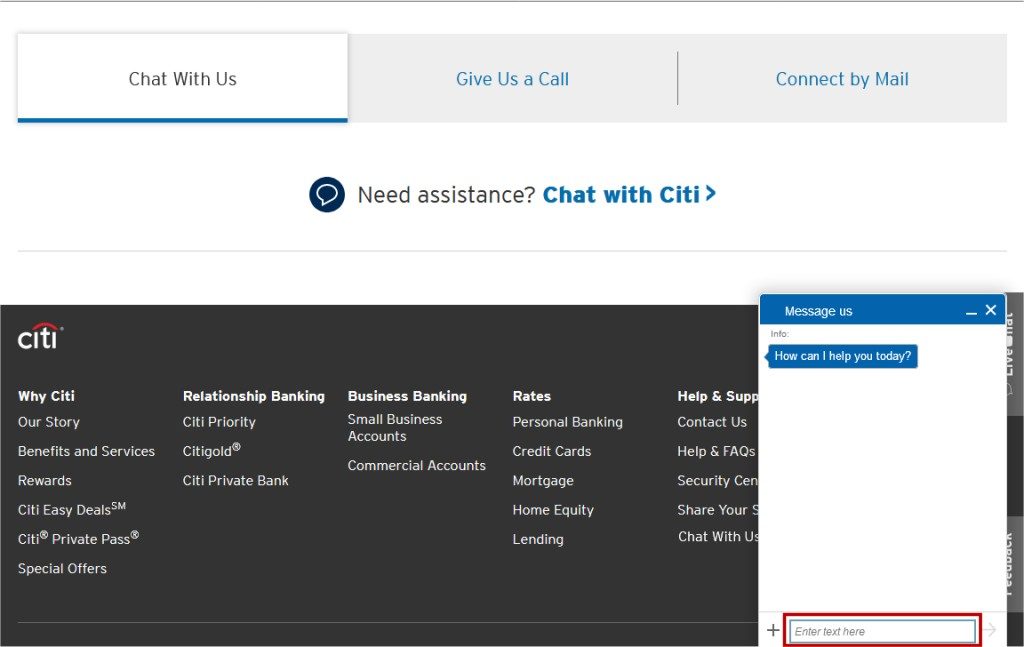

4. A chat box will pop up at the bottom of the screen allowing you to message Citi.

5. Type the below in the text box and click the arrow to send the message.

I would like to close my Citi credit card ending in ####.

Closing Your Citi Credit Card Account By Phone

You can find the telephone number for Citi customer support on the back of your credit card. If you do not have your card available, their general customer service number is available on their contact us page and also listed below:

Citi General Support: 1-800-950-5114

Citi American Airlines AAdvantage: 1-888-766-2484

Citi Business Cards: 1-800-732-6000

Citi CashReturns: 1-800-533-8617

Citi Costco Anywhere Visa: 1-855-378-6467

Citi Diamond Preferred Rewards: 1-800-633-7367

Citi Double Cash: 1-800-473-4583

Citi MasterCard: 1-800-510-2761

Citi Simplicity Cards: 1-800-696-5673

Citi ThankYou Cards: 1-800-842-6596

Once connected, follow the voice prompts and when the automated system asks the reason for your call, state “Cancel Card”. The voice attendant will then connect you with a call center representative to assist you.

Cancel Your Citi Credit Card By Mail

You can find the mailing address for Citi by looking at the top of your monthly credit card statement. If you do not have that available, you can find their general mailing address below or on their contact us page. Do not send correspondence to the payment address.

Citibank Customer Service

P.O. Box 6500

Sioux Falls, SD 57117

Sample Citi Card Cancellation Letter

Below is a sample letter you can copy and paste to your Word document. Replace the the text in red, fill it out, sign it, and mail it off to Citi. Be sure to keep a copy of the letter for your records.

Date

Your Name

Address

City, State ZipCitibank Customer Service

P.O. Box 6500

Sioux Falls, SD 57117Re: Closing of CITI CREDIT CARD NAME Account

Dear Sir or Madam:

This letter is my official notice that I am terminating my CITI CREDIT CARD NAME credit card effectively immediately. Please close the below account and send a written confirmation that the account has been closed.

Name On Card: _____________________

Account Number: ___________________

Please also notify the credit bureaus that this account has been “closed by request of cardholder”.

Sincerely,

Your Name

Phone Number

Closing Your Citi Card and Your ThankYou Rewards Points

If you have a Citi bank credit card such as the Citi Prestige, Citi Preferred, Citi Premier, and other similar cards where you are earning ThankYou rewards points for purchases, according to the terms and conditions, when you close your account you have 60 days to redeem your points or you will lose them.

While you can combine Citi ThankYou points from multiple cards into one ThankYou account, your points still follow the card from which they were earned. That means the points earned with the canceled card will be lost after 60 days even though your other cards and ThankYou account are still active.

You can transfer your Citi ThankYou points to another ThankYou account holder, such as your spouse. However, the points will still expire 90 days after the transfer was made or 60 days after card cancellation, which ever comes first.

To keep your points longer, what you can do is transfer your Citi ThankYou points to an airline or hotel partner. Once your points are in the partner’s account, they are under that partner’s expiration terms.

As of this writing, these are the airlines and hotels that you can transfer your ThankYou points to:

| Citi ThankYou Points Transfer Partners | ||||

| Asia Miles | Avianca LifeMiles | Etihad Airways | EVA Air | Flying Blue |

| Garuda Indonesia | JetBlue | JetPrivilege | Malaysia Airlines | Qantas |

| Qatar Airways | Singapore Airlines | Thai Royal Orchid | Turkish Airlines | Virgin Atlantic |

If you are canceling the Citi AAdvantage card, and your points are already in your American Airline’s miles account, then you are set here.

Canceling Your Citi Credit Card and Your Credit Score

With the current FICO credit scoring calculations, closing a credit card may affect your credit score. How much of an effect will depend on how long you’ve had your Citi credit card and its credit limit.

Closing a recently opened credit card or a card with a smaller credit line will have a smaller effect on your credit score due to how credit scores are determined. The length of your credit history makes up 15% of your credit score while the revolving credit utilization ratio is 30%. Since the utilization ratio is double the weight of the account history, your credit score will take a less of a hit if you have plenty of other credit available on your other credit cards, and closing your Citi card doesn’t bump your utilization ratio up too high. A good rule of thumb is to keep your total debt-to-credit ratio below 30%.

If you are looking to close your Citi account because of its costly annual fee and you are worry about it lowering your credit score, one thing you can do is convert your card to one that does not have an annual fee.

Thanks for the great helpful summary. For me, the SECURE MESSAGE CENTER interface has changed in January 2019 – now only allows me to “Read Messages from Citi in the Secure Message Center” – cannot send them correspondence.

Hi Dane, Thanks for the update. I’ll update this post later, but for now people should still be able to cancel online by clicking the “Chat With Citi” link to be connected with a live representative instead of going to the Secure Message Center on their Contact Us page.

Hi, I was able to cancel with the chat representative and did not need to speak with a customer service rep.

Good to hear that you were able to cancel your card easily via their online chat.

In 2020, Citicard told me NOPE have to phone, this was through the chat service, thanks to your info, we are sending written letter (copy to file) with cut up card, the guy was from another country so language was an issue, and kept insisting we phone them and ( wanted to talk us into staying) anyhow, what a hassle, but in Feb. 2020 that is the problem with Citicard for American AAdvantage.

Hi Lance,

Thanks for the update. For some cards with an annual fee, people would get offers to have the fees waived after talking to a customer service rep so I can see why they’d prefer people to call. That way, they can try to convince them to stay a customer.

I just cancelled a CapOne card online and it was extremely easy. I will never get another citicard.

Hi Chris, thanks for your feedback. Yes, Capital One is one of the easier cards to cancel online once you find the Close Account link on their Account Summary page.

Chat feature is no longer available on the Citi Bank website that my card is on

8-17-21

my bad, I did find the Chat feature on Citi.com. There is no separate “Chat with us” link.

I first had to click on “contact us” to find the chat feature.

Still took about 15 minutes, but I was able to cancel